When it comes to obtaining financing to grow your app or game business, there are several options from which to choose that take a debt-based approach, rather than giving away equity in your business. Choosing the right type of financing is critical; making the wrong choice can be costly in both financial and non-financial terms.

When it comes to obtaining financing to grow your app or game business, there are several options from which to choose that take a debt-based approach, rather than giving away equity in your business. Choosing the right type of financing is critical; making the wrong choice can be costly in both financial and non-financial terms.

Smart developers consider accounts receivable (AR) financing or venture debt as suitable sources of financing because they are generally low cost and don’t dilute their equity. However, many often don’t read the “fine print,” which can lead to them signing away more than they need to. So how can you avoid this increasingly common pitfall?

One of the keys to making the right financing choice is understanding the concept of liquidation preferences. When lending money, banks or venture debt providers will require you to pledge certain assets as security against the funds advanced. This is known in the U. S. as a lien (or a charge in the U. K.). Liquidation preference determines which creditors are paid out first if your company ends up in financial difficulties and goes into receivership.

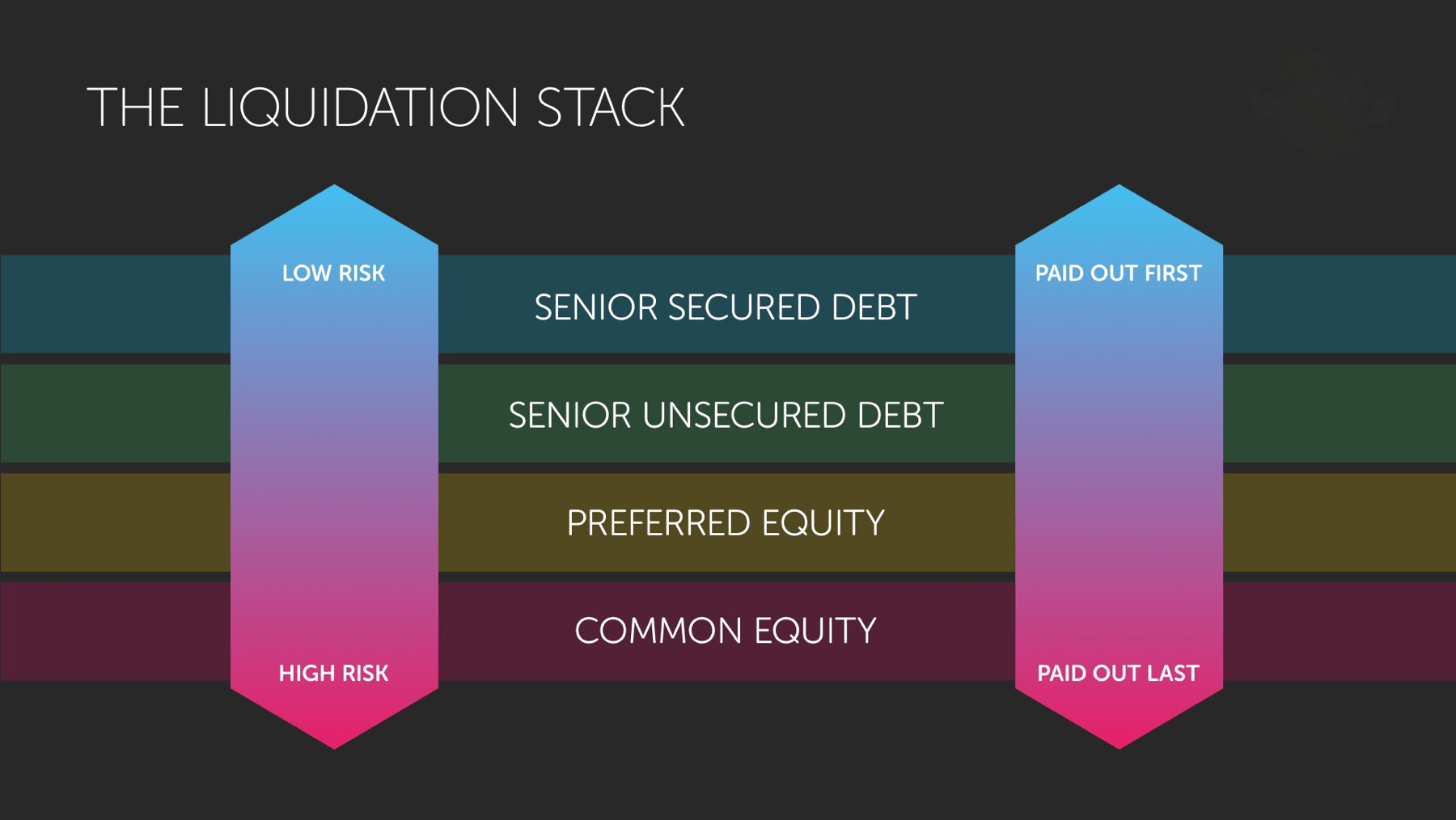

In order to get paid in the event of insolvency, creditors must have a valid and properly secured interest in a specific business asset or assets. But these interests are not all equal. Typically, the ranking order of liquidation preference is as follows:

When considering debt financing for your app business, it’s critical that you understand this order of liquidation preference. You also need to understand the specific assets you are pledging as security for your loan — because creditors holding liens on specific assets have liquidation preference over other creditors. This means that they get paid out first in the event of an insolvency situation. And once assets have been pledged as security to one lender, they can’t be pledged again to another lender.

The assets you pledge as security should be appropriate for how you’re going to use the money you borrow. For example, if you’re borrowing money against your receivables to fund growth, you should only secure the loan against your receivables.