The collective intelligence of central bankers cannot outperform a yellow rock.

In 1971, the economist Arthur Laffer — he was the chief economist of the Office of Management and Budget at the time — was asked what he thought the consequences would be of Nixon’s “closing of the gold window,” which effectively ended the Bretton Woods period when the dollar’s value was fixed at $35/ounce of gold.

“It won’t be as much fun to be an American anymore,” Laffer reportedly replied. And he was right.

But why? Why is it that the collective intelligence (let’s be generous) of today’s central bankers, and indeed all the central bankers since 1971, cannot outperform a yellow rock? This probably strikes some as bizarre, but it has always been thus. Way back in 1928, in a book called The Intelligent Woman’s Guide to Socialism and Capitalism, George Bernard Shaw declared:

“You have to choose… between trusting to the natural stability of gold and the natural stability of the honesty and intelligence of the members of the Government. And, with due respect for these gentlemen, I advise you, as long as the Capitalist system lasts, to vote for gold.”

It’s the same today. These things never change. Ninety years ago, intelligent women understood these things.

To understand why gold works, as a standard of monetary value, you have to understand what makes good money. Today’s cryptocurrency enthusiasts are rediscovering what monetary thinkers have always known: that the best money is stable money, or, as I like to term it, Stable Money — money that is stable in value. After learning that Bitcoin and its ilk make splendid devices for gambling (the continued popularity of places like Las Vegas and Macau show that there remains a large interest in such things), but a rather poor currency — exactly as I said would happen some years ago — the cryptocurrency engineers are now focusing their energies on developing “stablecoins.”

Ideally, a currency would be perfectly stable in value. The market economy is organized via prices, profit margins, returns on capital and interest rates. Changes in the value of the currency derange this process, creating chaos and havoc. John Maynard Keynes described in 1923:

“[Markets] cannot work properly if the money, which they assume as a stable measuring-rod, is undependable. Unemployment, the precarious life of the worker, the disappointment of expectation, the sudden loss of savings, the excessive windfalls to individuals, the speculator, the profiteer–all proceed, in large measure, from the instability of the standard of value.”

In The Scandal of Money (2016), George Gilder updated this insight, using the tools of modern information theory:

“Casting a shroud of uncertainty over all valuation, monetary manipulations shorten the time horizons of the economy. In information theory, the dominant science of our age, when a medium sends a message of its own–static on the line–it’s called noise. Noise in the channel reduces the channel’s capacity to transmit accurate information.”

In practice, such idealized perfection is not quite possible, so we have to go with the next best thing. The next best thing is gold: the thing that most closely approximates this ideal of stability of value. President James Madison summed up succinctly:

The only adequate guarantee for the uniform and stable value of a paper currency is its convertibility into specie [gold]–the least fluctuating and the only universal currency.

James Madison understood this.

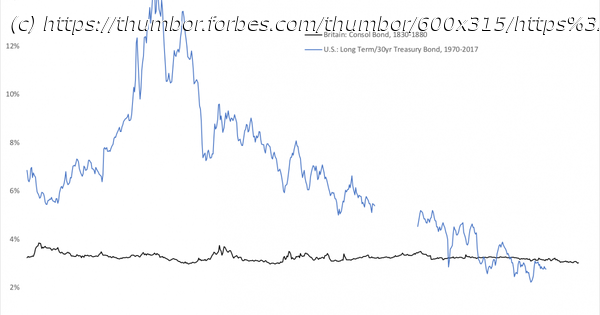

And the United States became one of the most successful countries in the history of the world because people like James Madison understood it, and adhered to this principle from 1789 to 1971.

In this single sentence, Madison touched on some important political truths. You might argue that, ideally, “smart people” could get together and create some better — that is, more Stable — foundation for money than gold. But, you might also notice that nobody actually does this. They don’t even try, and never have, in the past five decades of floating fiat money. One reason for this is that they are human: consequently, they crumble to political pressures, while gold does not. Even if you could invent some statistical concoction that is a better measure of Stable Value than gold — although no human ever has — arguably, no human institution could ever implement it for any length of time. Just look at how statistical concoctions like the Consumer Price Index have been continually altered, each time in response to political pressures, and to serve political ends. This is one reason why, as Madison asserted, gold remains “the only adequate guarantee for the uniform and stable value of a paper currency.”

Related to this is the fact that gold is the “only universal currency.” It is the only thing (along with its adjunct silver) that all people have agreed to use as the basis of money, which then allows fixed exchange rates between countries, vastly simplifying trade and investment. In the pre-1914 era, most major governments participated in the world gold standard, which was simply the extension of many centuries of gold and silver coinage used throughout the world. This system was reassembled during the 1920s, and again in 1944, at Bretton Woods. We have had no difficulty establishing world monetary systems based on gold.

Contrary to popular belief, most countries today do not have freely-floating currencies. According to the International Monetary Fund, about half of all countries actively “anchor” their currencies to something else, usually a major international currency like the dollar or euro.