If oil prices rebound however, it is likely that earnings would grow as well, making Buffett’s investment in Chevron smart in hindsight.

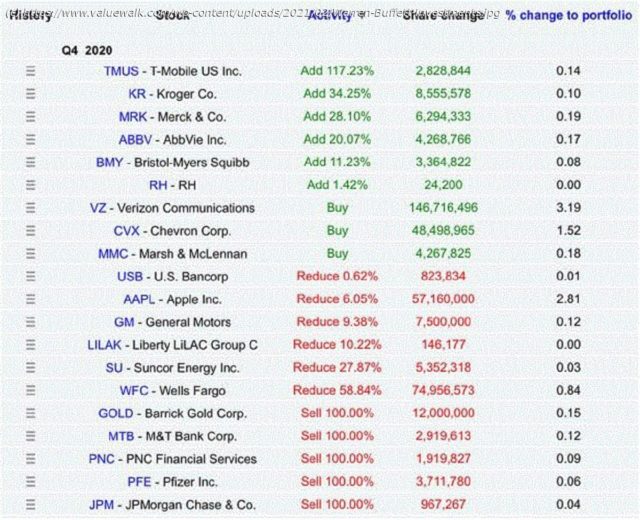

Warren Buffett does not need any introduction. He is a very successful investor who is in charge of Berkshire Hathaway. He has an impressive track record investing in the stock market and in businesses. Q4 2020 hedge fund letters, conferences and more Because of his success, his every move is followed very closely. For example, his holding company Berkshire Hathaway is required to file a report with the SEC once per quarter that shows a listing of its portfolio holdings. You can find the most recent report by clicking on this link to the SEC filing. It looks like Buffett initiated a position in three dividend growth companies. These are Chevron (CVX), Verizon (VZ) and Marsh & McLennan (MMC). I wanted to provide a brief overview of each company, from the perspective of a dividend growth investor below: Chevron Corporation (CVX) engages in integrated energy, chemicals, and petroleum operations worldwide. The company operates in two segments, Upstream and Downstream. Chevron is a dividend aristocrat with a 33 year track record of annual dividend increases. Over the past decade, it has managed to grow dividends at an annualized rate of 6.20%. The stock is selling for 26.63 times forward earnings and yields 5.58%. I do not believe that the annual dividend of $5.16/share is safe, based on forward earnings of $3.48/share. If oil prices rebound however, it is likely that earnings would grow as well, making Buffett’s investment in Chevron smart in hindsight. Marsh & McLennan Companies, Inc.