As a General Electric shareholder, I am thrilled to learn that GE will split itself into three public companies.

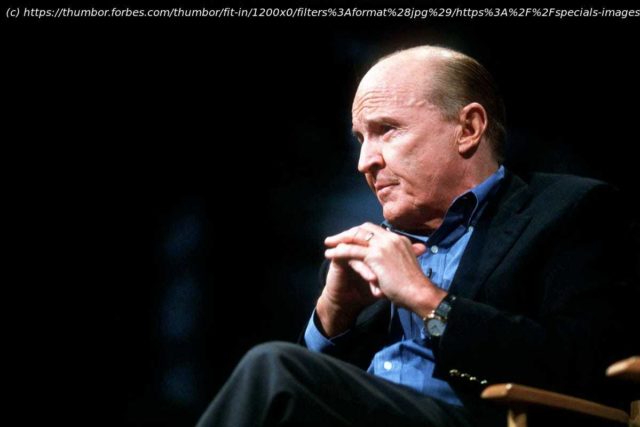

As a General Electric shareholder, I am thrilled that GE will split itself into three public companies, according to the Wall Street Journal. The stock is up 8.8% in November 9 pre-market trade despite considerable uncertainty, I will hold on to my shares. It has been over 21 years since GE stock peaked at $465 a split-adjusted share in September 2000 when GE’s last great CEO, Jack Welch, was nearing the end of a fantastic two-decade run. It was Welch who presided over the last gasp of the idea that conglomerates could be successful. The double-digit earnings growth and steady stock price increase under his watch defied the idea that a portfolio of companies in unrelated industries would be worth more as independent companies. Since Welch left the scene, its stock has plunged and it now stands a whopping 77% below its all-time high. By splitting into three public companies, GE will no longer be a conglomerate. With details of how current shareholders will fare, it is too early to tell whether GE shareholders should hold on. But I will stock around to see whether the parts are worth more than the whole. GE announced on November 9 that it plans to split into three public companies focused on aviation, healthcare and energy. Here is the plan: GE expects to incur about $2 billion in one-time separation, transition and operational costs, and less than $500 million in tax costs. GE is thrilled with this move. As CEO Larry Culp said in a statement, “By creating three industry-leading, global public companies, each can benefit from greater focus, tailored capital allocation, and strategic flexibility to drive long-term growth and value for customers, investors, and employees.