Array

The collapse of Silicon Valley Bank was caused by a massive run on the bank, with customers initiating withdrawals of $42 billion this week.

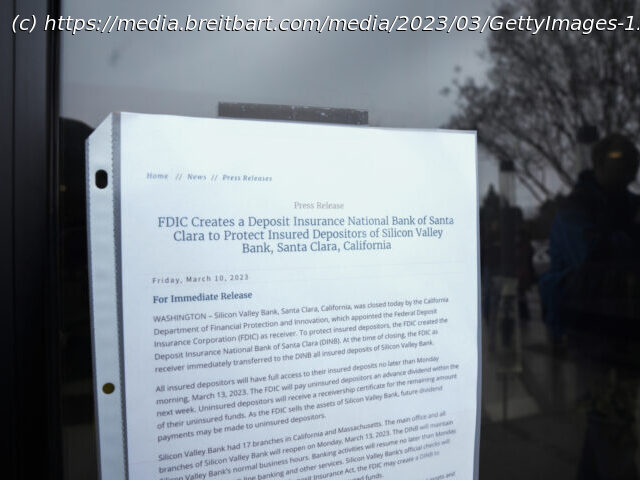

The bank was placed into Federal Deposit Insurance Corp. receivership on Friday after the California Department of Financial Protection and Innovation (DFPI) determined the bank had been rendered insolvent.

Prior to the run on the bank, the bank was in “sound financial condition,” according to the DFPI. Customers withdrew $42 billion, leaving the bank with a negative cash balance of $958 million.