When equity markets display significant volatility on a day-to-day basis and even intraday, it suggests that the themes that have been driving markets are changing.

When equity markets display significant volatility on a day-to-day basis and even intraday, it suggests that the themes that have been driving markets are changing. Lately, on net, we’ve seen the equity markets retreat from their July peaks, with the Nasdaq down more than -10% from its peak, officially putting it into “correction” territory.

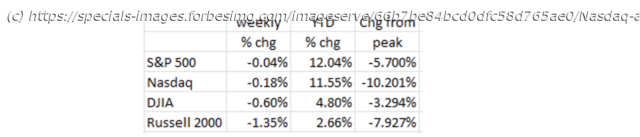

Despite this correction, the table also shows that the Nasdaq and the S&P 500, while down again this week, are still up double digits this year with the DJIA and the small cap Russell 2000 also positive, but less so. The question is, did the equity market get too far ahead of itself and is just correcting, or is the incoming economic data pointing to something more sinister (like an economic slowdown and/or a Recession)?

The chart below shows that of all of the eight measures of valuation for the S&P 500, seven are at extremes. And even the eighth measure is on the high side. Theoretically, at least according to history, even if the economy ends up in a soft-landing, the valuation measures are going to mean revert. That likely means continued volatility in the major indexes.What Initiated the Equity Downdraft

The immediate cause of the equity selloff appears to be the unwinding of the Japanese Yen “carry trade.” What’s that, you ask? Here is a synopsis of a possible “carry trade.”

A hedge fund sells short say $10 million of Japanese Government Bonds that yield less than 0.5% and receives about $10 million (American) in cash (effectively shorting the Japanese Yen). Then it buys about $10 million of high-quality bonds, say U.S. Treasuries with a significant yield (4%) and captures the 3.5% spread. The Hedge Fund then leverages the $10 million Treasuries into $100 million and buys other assets including equities.

When the Bank of Japan unexpectedly raised their short-term interest rate on July 31st (thus raising the value of the Yen), those short-positions began to lose money as the value of the Yen appreciated against the dollar. As a result, the trades were unwound – first selling the equities, then the Treasuries, and then repurchasing the Japanese Government Bonds, thus covering the short. While the buy side of the “carry trade” occurred over a long period of time, all the selling happened in a very short period (July 31st to August 5th) and caused a dramatic drop in equity prices (the Nasdaq fell nearly 8% over that period).

In addition, when the Nonfarm Payroll report came out last Friday (August 2nd), showing a rise in the U3 unemployment rate from 4.1% to 4.3% (the U6 unemployment measure rose even further, from 7.4% to 7.7%), markets reacted, clearly recalibrating their view of whether or not the economy would have a “soft-landing.” After all, the U3 triggered the famous (infamous) Sahm Rule (which says that in the post-WWII period, when the U3 rate has risen 0.5 percentage points from its 12-month low, a Recession occurs). Currently, the U3 has risen 0.8 percentage points from its 12-month low of 3.5% in July 2023 (and 0.9 percentage points from its 3.4% cycle low in May 2023), thus triggering the Sahm rule. Yet, despite the rise in the unemployment rate, there are widely divergent opinions among economists as to whether or not the economy will have a soft landing, will fall into Recession, or will keep growing. Note that Claudia Sahm, author of the Sahm Rule, recently said that “this time is different,” i.e., to ignore her Sham Rule signal! Afterall, the Federal Reserve Bank of Atlanta’s GDP Now forecast says that Q3 GDP will grow at a 2.9% annual rate (about the same as Q2’s 2.8% print). And even the St. Louis Fed’s GDP model, which, historically, is more conservative than the Atlanta Fed’s model, forecasts Q3 GDP growth at 1.

Home

United States

USA — Financial Are Equities Just Correcting, Or Is There Something More Sinister?