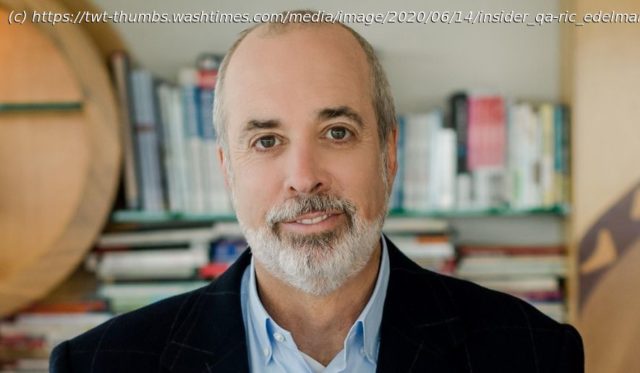

Ric Edelman, founder of financial-advisory firm Edelman Financial Engines, has helped clients navigate several downturns over the decades, and in some ways this one…

Ric Edelman, founder of financial-advisory firm Edelman Financial Engines, has helped clients navigate several downturns over the decades, and in some ways this one is just like any other.

But this crisis is increasing the urgency for some discussions that weren’t as big priorities in past bear markets, he said in a recent conversation with The Associated Press. His firm’s clients have over $200 billion in assets under its management.

The conversation has been edited for clarity and brevity.

Q: Have your clients been more scared about this downturn than others?

A: From a financial perspective, this downturn is like other downturns, and our clients have been through many of them. They know that in the long run, markets recover and ultimately reach new highs and therefore require three things: a diversified portfolio, a long-term time horizon and the fortitude and emotional capacity to hang in there when it gets very dark.

With those three in mind, clients realize that this too shall pass. There was much greater fear in ‘87 and after 9/11 and the dot-com bubble than there is today. They went through them, and they got through it OK.

Q: So your advice is the same as in past crises?

A: There is another element to this crisis that the others did not have, which is the health care element. That is causing a level of concern that would not exist if this was merely a “financial crisis.”

Q: If we can wait before discussing health care, it sounds like your clients weren’t panic selling when stocks were tanking?

A: Our clients were generally not reacting with panic because they were properly positioned going into this crisis, and they had the education and knowledge of knowing why they were invested the way they were.