Tax break conferred under $1.9 trillion stimulus package could save many U.S. taxpayers thousands of dollars.

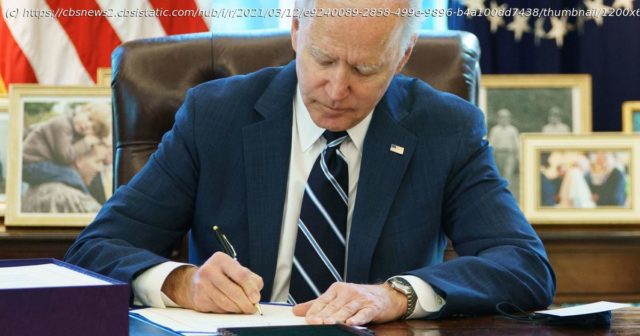

The signed into law this week includes a welcome tax break for unemployed workers. The law waives federal income taxes on up to $10,200 in unemployment insurance benefits for people who earn under $150,000 a year, potentially saving workers thousands of dollars. States that currently tax unemployment benefits have yet to decide whether they will allow those state taxes to be waived as well. The change is good news for many taxpayers, who could save as much as $25 billion, according to the Wall Street Journal. But it also affects an already complex tax season for a tax collection agency that is already behind thanks to understaffing and disruptions. In most years, yes. The federal government considers unemployment benefits to be taxable income, although taxes are not automatically withheld from benefits payments, the way an employer might take taxes out of your paycheck. Instead, unemployment recipients must request that taxes be withheld from their benefits form, and the withholding is limited to 10%. This led to for the unprecedented number of workers who received jobless benefits for part of 2020 and filed their taxes for the year only to find their typical refund reduced — or in some cases to be told they owe money. Michigan resident Bridget Harwood was furloughed from her medical assistant job for three months last year when many businesses in her city closed. The unemployment benefits she received during that time also resulted in a smaller tax refund this year. Instead of the roughly $1,500 refund she typically receives, she got just $72 back. “It was definitely a shock,” Harwood said. It was even worse for Harwood’s eldest daughter, who worked at a fast-food restaurant before the pandemic pushed her into unemployment. Harwood filled out her daughter’s tax return and found that she owed $1,000 in federal and state taxes.

Home

United States

USA — Financial $10,200 in unemployment benefits won't be taxed thanks to American Rescue Plan