Twitter shares closed Friday at $49.02, corresponding to a discount of $5.18 relative to the offer price of $54.20 from the CEO of Tesla

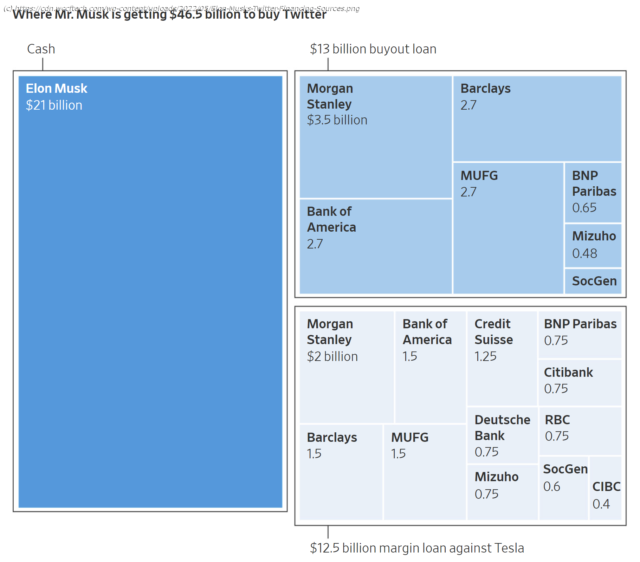

Twitter ( NYSE:TWTR) shares closed Friday at $49.02, corresponding to a discount of $5.18 relative to the offer price of $54.20 from the CEO of Tesla ( NASDAQ:TSLA) for the social media giant. The existence of this sizable arbitrage lends credence to the hypothesis that the market is currently discounting Elon Musk’s ability to close his Twitter takeover deal. As most of our readers would know by now, Elon Musk plans to take Twitter private at $54.20, equating to a deal price tag of around $43 billion. The following infographic details the various funding sources that the CEO of Tesla has now tapped to close his Twitter takeover deal. Has Elon Musk Already Breached the Terms of the Twitter Sale Agreement by Touting Trump’s TRUTH Social Platform? As is evident, Musk is required to cough up around $21 billion from his own resources, with the residual $22 billion expected to materialize in the form of loans. Prior to the finalization of the Twitter deal terms, Musk had $3 billion in on-hand liquidity. Over the past few days, Musk has liquidated 9.645 million Tesla shares, netting around $8.5 billion in the process. However, this liquidation spree has endangered Musk’s margin loan financing for the Twitter deal. Let’s delve deeper. The $12.5 billion margin loan facility that Musk has tapped to fill the liquidity gap for the Twitter takeover deal has a loan-to-value ratio of 20 percent.