The application for the student loan forgiveness plan is now open, and the administration says the forms should take five minutes to complete.

President Joe Biden’s student loan forgiveness program. announced in August, will cancel up to $20,000 in debt per borrower. The application process is now open, and the administration says the forms should take five minutes to complete.

Borrowers who apply before mid-November should see forgiveness before Jan. 1, when payments on loans are scheduled to restart after a pause during the pandemic. Some Republican-led states have filed lawsuits to try to stop the cancellation, but the Biden administration says they’re confident the challenges won’t succeed.

Here’s how to apply, and everything else you need to know:

WHO QUALIFIES FOR STUDENT LOAN FORGIVENESS?

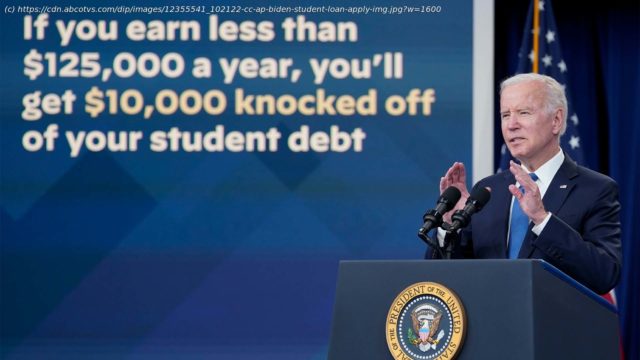

You qualify to have up to $10,000 forgiven if your loan is held by the Department of Education and you make less than $125,000 individually or $250,000 for a family. If you received Pell grants, which are reserved for undergraduates with the most significant financial need, you can have up to $20,000 forgiven. If you are a current borrower and a dependent student, you will be eligible for relief based on your parents’ income, rather than your own.

One major lingering question is what will happen to students with commercially held FFEL loans who didn’t refinance before Sept. 29. At the moment those loans are not eligible (even though they were initially going to be eligible). The administration has said it’s looking for “additional legally-available options to provide relief” to those borrowers, but nothing has been announced yet.

HOW DO I APPLY FOR LOAN FORGIVENESS?

Go to studentaid.gov and in the section on student loan debt relief, click “Apply Now.”

Be ready to type in some basic personal information. The form asks for: name, Social Security Number, date of birth, phone number and email address. It does not require documentation about your income or your student loans.

Next, review the eligibility rules and confirm that you’re a match. For most people, that means attesting that they make less than $125,000 a year or that their household makes less than $250,000 a year. If you meet the eligibility rules, click the box confirming that everything you provided is true.

Click “Submit.”

HOW LONG WILL IT TAKE TO RECEIVE FORGIVENESS?

After the form is submitted, the Biden administration says it should take four to six weeks to process. The Education Department will use its existing records to make sure your loans are eligible and to look for applicants who might exceed the income limits. Some will be asked to provide additional documentation to prove their incomes. The Education Department estimates that the verification application will take about half an hour, including time to review and upload tax documents.

Most borrowers who apply before mid-November should expect to get their debt canceled before Jan. 1, when payments on federal student loans are scheduled to restart after a pause during the pandemic.

WILL STUDENT LOAN FORGIVENESS DEFINITELY HAPPEN?

Things could get more complicated, depending on the outcomes of several legal challenges. The Biden administration faces a growing number of lawsuits attempting to block the program, including one filed by six Republican-led states.