Apps, streaming services and software subscriptions can quietly rinse your savings – as I learnt the hard way. Here’s how to avoid the same fate.

Tech has always been an expensive hobby, but that’s particularly the case today. The main reason is because companies have fully weaponized the power of subscriptions for software and services. These stealthy recurring payments can quickly make your bank account feel like a colander, and it was only when I recently did an end-of-year audit that I realized quite how much money was going down the plughole.

After totting up my monthly and annual subscriptions for streaming services, apps, desktop software and cloud storage, I nearly fell off my subscription chair. I was spending about £222 a month (around $270) on tech-related stuff. When I multiplied this by twelve for the annual outlay my calculator simply displayed a grimace emoji. The total was about the same as the average yearly cost of owning three cats.

It wasn’t really Netflix or Spotify that were to blame. It was the stealthy bloodsuckers, the ones with recurring annual payments or services that preferred to keep quiet, rather than emailing, when a renewal was coming. Okay, there were also a few free trials that I’m sure I set reminders for, but then probably got distracted by a special offer for The Cheese Geek (yes, it’s a cheese subscription service).

There’s clearly nothing wrong with paying a subscription for something you use regularly. I still happily pay for comparative bargains like Readly (above) and Google Drive, and get value from Adobe’s Photography bundle (even if I am considering non-subscription alternatives like Capture One). But I was only really using about half of my subscriptions, and I’m certainly not the only one.

In the US, a survey by market research company C+R (opens in new tab) found that the actual monthly spend on subscriptions was two-and-a-half times what its respondents’ had estimated. And in the UK, Lloyds Bank (opens in new tab) revealed that its customers had cancelled over a million subscriptions in the ten-month period to April 2022, probably after doing a similar jaw-dropping audit as mine.

In a world of spiraling costs, my situation wasn’t sustainable, so I took a scythe to my overgrown subscriptions using the methods below. To make sure I can still enjoy some of the internet’s digital fruits this year, I also consulted our friends at The Money Edit (opens in new tab) for some extra guidance on how to maximize subscription freebies without falling into the same trap. I’m clearly no financial advisor – the guidance below is simply what worked for me and will, my bank account is hoping, continue to bear financial fruits in this tricky year.

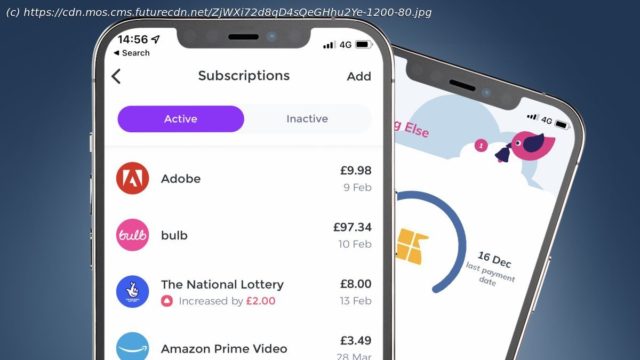

The most important first step is to audit your subscriptions. This can be trickier than it sounds, particularly if your banking app doesn’t have great financial management features. The simplest approach is a spreadsheet in the likes of Google Sheets or Excel, but that also’s time-consuming and lacks some of the push alerts you can get from subscription managers.

The latter fall into three main camps. There are free apps like Little Birdie (opens in new tab) (iOS and Android), paid browser-based managers like TrackMySubs (opens in new tab) ($10 per month) and full-blown financial management apps like Emma (opens in new tab) (£4.

Home

United States

USA — software I wasted megabucks on tech subscriptions – here's how to avoid my...