Apple will now begin giving out loans for big purchases; however, some rules and stipulations do apply.

After suffering through multiple delays, Apple Pay Later is finally touching down as it begins rolling out to randomly selected users across the United States.

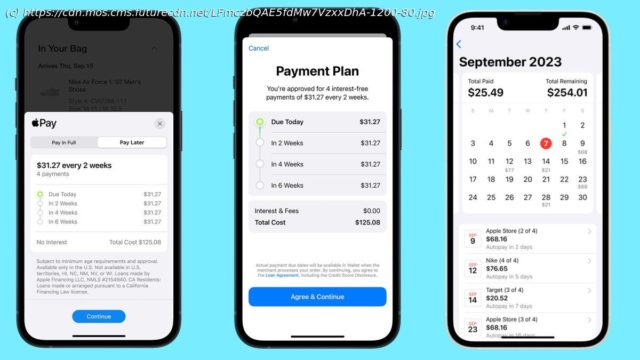

Originally, the service was supposed to launch alongside iOS 16 back in September 2022, but developers ran into a variety of “technical setbacks”. Apple Pay Later (opens in new tab) allows people to apply for loans from $50 up to $1,000 to purchase whatever they want while avoiding paying the full price up-front. From there, users will pay off that amount in four separate payments across six weeks with no interest or extra fees slapped on top. $1,000 is a decent chunk of change, however, it’s not a guarantee. Eligibility depends on your credit score; a history with low numbers will qualify for smaller loans.

The feature will have its home in the Apple Wallet (opens in new tab) which comes with a detailed calendar that’ll notify you of upcoming payments. If you’re having a hard time paying, Apple will work with you to make up a new plan. And if you still can’t pay off the bill, you won’t be eligible for future loans. Customers must connect either a bank or debit card to their account to use the money. Credit cards cannot be used in order to, as Apple notes in its release, “prevent users from taking on more debt to pay back loans”.