Array

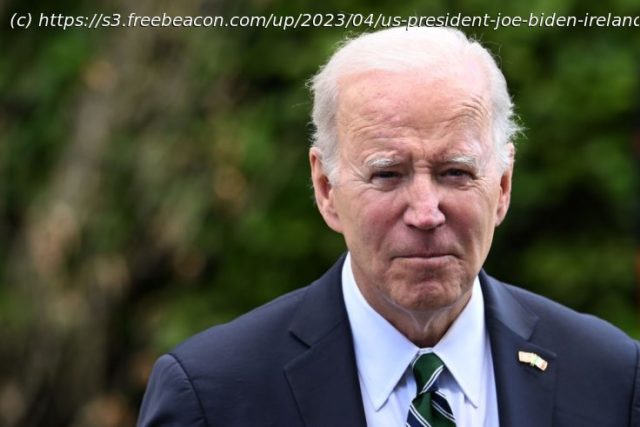

U.S. President Joe Biden’s 2020 campaign promise to make wealthy Americans and corporations pay more in taxes to finance a range of social priorities breathed its last gasp, at least for this presidential term, with the debt ceiling deal he struck with Republicans on Saturday.

The deal to cap discretionary spending and suspend the debt ceiling contains no tax rate changes to raise revenue; it also slashes new funding Biden had allocated to the hollowed-out Internal Revenue Service. The agreement caps Republicans’ successful defense of the debt-boosting 2017 Trump tax cuts against withering criticism from Biden and several attempts by his Democrats to reverse them for wealthy Americans.

Barring an unlikely Democratic sweep of the White House and both chambers of Congress in 2024, major changes to the U.S. tax code are now seen as largely off the table until the end of 2025, when the 2017 individual tax cuts expire. Then, tax experts predict lawmakers will be forced to agree on a major tax revamp.

“Things are getting set up for a big fiscal cliff in 2025. That’s the next opportunity for major changes,” said William McBride, vice president of federal tax policy for the Tax Foundation, a conservative think tank in Washington.

Polls show the idea of fighting glaring income inequality with tax increases on the wealthy and corporations is hugely popular with Democratic and Republican voters.

TAX CHANGES ARE TOUGH

Biden’s unrealized campaign tax pledges illustrate the political difficulty of changing the U.S. tax code, barring a commanding majority in Congress.

His $4 trillion, two-part “Build Back Better” plan included infrastructure, clean energy incentives, workforce development, child care, paid family leave, free community college, expanded child tax credits and other initiatives.