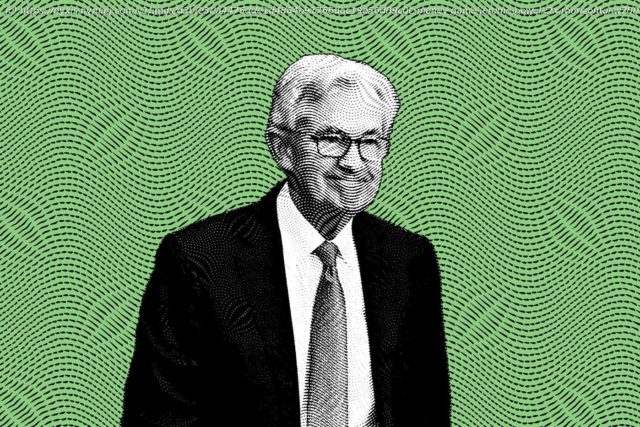

Investors think Federal Reserve chair Jerome Powell has finally pivoted away from his war on inflation, and that’s causing stocks, bonds, and everything else to soar.

Federal Reserve chairman Jerome Powell refused to declare victory over inflation. “The path forward is uncertain,” he said at an afternoon press conference following the central bank’s decision to keep interest rates steady. Yes, he said, things were getting better. Inflation was lower. The economy wasn’t about to fall off a cliff or lapse into another era of high inflation. The Fed’s Board of Governors — typically a pretty conservative lot — even predicted the central bank would cut interest rates three times next year, a minimum of 0.75 percent. Still, Powell said, it was too early to say “mission accomplished.”

That didn’t stop Wall Street from going absolutely apeshit. Since Powell stepped away from his press-conference podium yesterday, investors have been staging one of the biggest year-end rallies in decades, buying up anything and everything. The Dow Jones Industrial Average notched a new all-time high. Ten-year Treasury bond yields — typically a measure of economic health — zoomed below 4 percent, the lowest since July. (Bond yields are a mirror image of price, so the lower they are, the higher the demand.) As the investor class digested Powell’s statements, it concluded that inflation is no longer the threat it once was, and the party was back on.

???? THE FED’S DECEMBER ANNOUNCEMENT ????

⛰ Rate hikes are likely done

✂ A few cuts could be coming next year

????Inflation forecasts come down

????Unemployment forecasts are still low

✈ We are SO close to landing the plane, folks!— Callie Cox (@callieabost) December 13, 2023

This is, in effect, the so-called pivot the markets have breathlessly been calling for — and not getting, no matter how many times Powell has said so.