The break higher in the stock market looks like it can continue, because banks are leading the way again.

The break higher in the stock market looks like it can continue, because banks are leading the way again.

Without that financials sector, the S&P 500 would be less than 2 percent above an old record hit Aug. 15, 2016, rather than posting the more than 4 percent gain it’s had since then, according to Howard Silverblatt of S&P Dow Jones Indices. His data show that Goldman Sachs alone has accounted for 22 percent of the Dow Jones industrial average’s gains since the election.

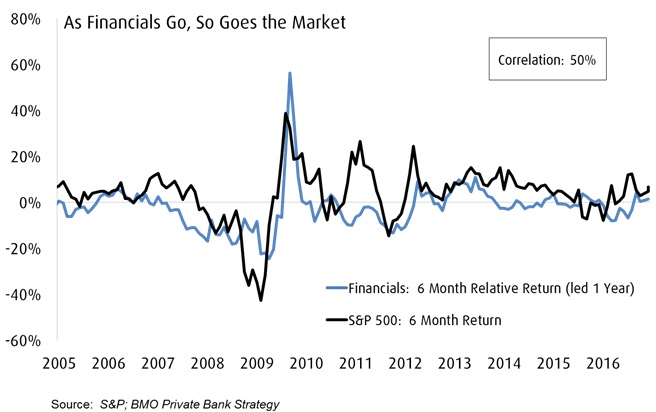

„It’s very difficult to get a sustained rally without the financials rallying,“ Jack Ablin, chief investment officer at BMO Private Bank, told CNBC in December.

Financial stocks declined by 0.47 percent between the end of 2014 and Election Day 2016, and the S&P 500 took more than a year to make a new high during that time.

By December, the sector had rallied more than 18 percent since election day in November, to hit its highest level in about nine years. The S&P 500 was up nearly 5 percent over the same period, setting all-time highs.

Now, the sector is recovering. Financial stocks led the S&P 500 higher Wednesday as the index traded at all-time highs and the Dow crossed the psychologically key 20,000 level for the first time. Boeing was the top contributor to gains in the Dow, while Goldman Sachs and JPMorgan Chase were among the top 10 stocks with the greatest positive impact on the index.

Ablin findings confirm that the S&P 500 tends to follow the performance of the financials sector, which has the second-greatest weighting in the index.

Banks are „really advancing on the back of higher interest rates. It’s probably the one sector that benefits from higher rates. I think investors are not only gravitating to it, but they are using it as a hedge,“ Ablin said. Higher interest rates increase banks‘ profit margins.

The financial sector is watched as an indicator of economic growth. The more business activity there is, the more loans are taken out, and the more money banks can make.

„It’s typically healthy that the financials are leading. It’s suggesting the economy is in good shape. It’s not something we’ve had“ over the last few years, said Bruce Bittles, chief investment strategist at Baird.

Financials were already on the rise ahead of the U. S. presidential election, as the economic outlook improved, as trading volumes picked up, and as global central bank monetary policy tightened.

Since the election, Treasury yields have jumped on expectations of economic growth stemming from Trump’s promised tax cuts and infrastructure spending. The Trump administration is also expected to roll back some of the regulations imposed on banks after the financial crisis.

„What we ultimately get is stimulus and regulatory rollback,“ said Tom Wright, director of equities at JMP Securities. He said those policies should have a much bigger effect than would a 25 basis point rate hike (0.25 percentage point) from the U. S. Federal Reserve.

„Generally, investors have been underweight (banks) for a long time, in the broader brush of things, since the financial crisis in ’09,“ he said. „This is a major shift, and there are larger pools of money that are going into financials. “

For example, in the week after the election, RBC Capital Markets began recommending financial stocks as the firm revised its views on seven S&P 500 sectors.

Bespoke Investment Group predicted in a December note that the sector still has room to run higher.

„Financials dropped more than 80 percent during the financial crisis, while the energy sector fell 40 percent from mid-2014 through January of this year,“ the note said. „So while sectors like consumer discretionary and industrials have also rallied sharply higher since the election, they have exploded higher into new all-time high territory. Financials and energy, on the other hand, both still need to gain roughly 30 percent to get back to their prior all-time highs. “

Meanwhile, the rally has spread. Not only have the S&P 500, Dow Jones industrial average and Nasdaq composite hit records, but so have the small-cap Russell 2000 index and the Dow transports. The S&P and Nasdaq closed at records Tuesday.

„From a technical standpoint, the situation has improved, even though valuations are stretched,“ said Ablin, who played down the concerns of investors „equaling this to a tech bubble of the late ’90s. “

„Now it’s just a matter of waiting for the fundamentals to catch up with what the expectations are,“ he said.