The latest data paint a picture of North Korea’s economy as stable, but strained.

The Hanoi summit is just days away, Daily NK recently put out new market price data, and I’ve finally had time to update my dataset. There seems like no better time than the present to take a look at some of the numbers we have available for the North Korean economy, thanks to outlets such as Daily NK and Asia Press/Rimjingang.

Currency

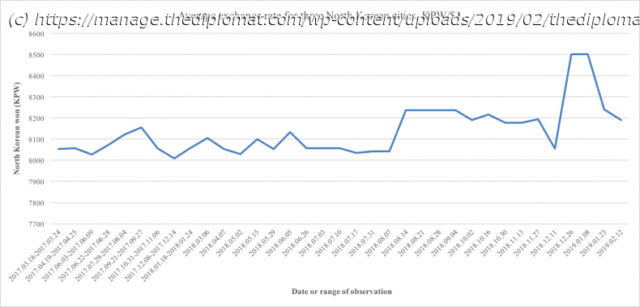

Let’s start with the exchange rate. A few weeks ago, the North Korean won depreciated quite significantly against the U. S. dollar, which I wrote about here. At 8,500 won/$1, the USD-exchange rate on the markets hit its highest point since the inception of “maximum pressure.” The graph below shows the average market exchange rate in three North Korean cities for won-to-USD.

As the graph shows, the won rebounded somewhat after the initial spike in early January. According to the latest data point, the exchange rate stands at 8,190 won/$1, still somewhat higher than the average for the period, 8,136, but barely.

What could have caused this spike? One possibility is that the government has started to soak up more foreign currency from the market, because the state’s foreign currency coffers are waning. Given the vast trade deficit, the continued necessity of spending hard currency on things like fuel (bought at higher prices through illicit channels to a greater extent), and other factors, this would make a great deal of sense. Currencies fluctuate all over the globe, sometimes based even on loose rumors that fuel expectations. One anonymous reader who often travels to North Korea for work heard from Korean colleagues that accounting conditions for firms had gotten stricter, likely because the government wants to be able to source more foreign currency from the general public.

It is also noteworthy that while the Daily NK price index reports that the USD exchange rate has gone back to more normal levels, the Rimjingang index remains at very high levels. Its latest report (from February 8) has the USD at 8,500 won, and on January 10, it registered 8,743 won, a remarkably high figure that the Daily NK index hasn’t been near since early 2015. The difference between the two may simply come from the figures being sourced from different regions, or a similar discrepancy. North Korea’s markets still hold a great deal of opportunity for arbitrage, not least because of the country’s poor infrastructure.

It does seem like there may be some unusual pressure on the won against the dollar. The cause is less clear, but the state demanding more hard currency from the semi-private sector and others may be one important factor.