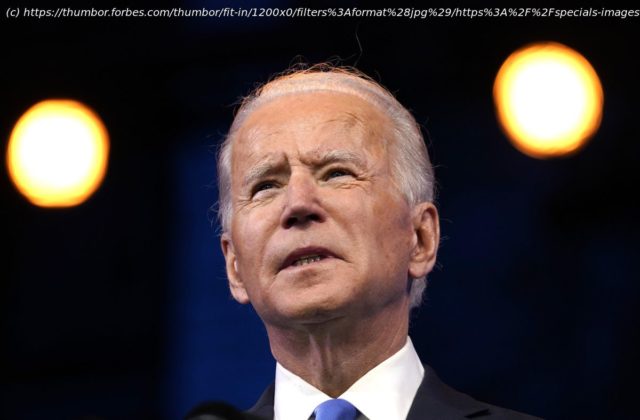

One opening question for the new Biden Administration is how they might deal with cryptocurrencies and bitcoin.

One opening question for the new Biden Administration is how they might deal with cryptocurrencies. It’s not going to be an issue that is central to the administration directly, yet with the emergence of the digital yuan from geopolitical competitor China, and inflationary monetary policy meant to gear a recovery in employment rates, the questions on the economy, great power competition and digital rights around the world, central themes of bitcoin, will be immediate priorities. A Biden Administration will have to weigh its policy tools and speeches carefully in an age of emerging “great power” conflict, protest movements around the world, and the economic stagnation that has come from the COVID-19 pandemic. The theme of bitcoin and cryptocurrencies is not just one of direct regulations and laws, but rather its outsize effect on international geopolitics, finance and political relations. This article isn’t meant to be legal advice of any sort, but rather a walkthrough of the different issues, laws, and regulations an incoming Biden Administration may face with bitcoin. Currently, bitcoin is “directly” regulated at the federal level by the Office of the Comptroller of the Currency (OCC) with regards to its custody, and the US Commodity Futures Trading Commission (CFTC) under the Commodity Exchange Act (CEA). There is an intersection with the IRS on tax policy, where transparency rules on disclosure and its classification as property means cryptocurrency holders have to pay federal capital gains tax. Exchanges of cryptocurrencies and bitcoin may be subject to the Bank Secrecy Act and its registration/disclosure requirements. Cryptocurrencies and bitcoin are not insured by the Federal Deposit Insurance Corporation (FDIC). Jay Clayton, the former chairman of the SEC affirmed that he determined that “bitcoin was not a security” so it did not fall under the SEC’s purview of regulation, unless people use crypto assets as securities to raise capital for a company or venture such as in the case of ICOs. A few Biden nominees and advisors have expressed opinions on bitcoin. They might be a reflection of his approach to decentralization and cryptocurrencies. Perhaps the most important of these is Janet Yellen, Biden’s nominee to head the Treasury Department. She was the former chair of Economic Advisors during the Clinton Administration, and the chairwoman of the Federal Reserve System. She has said that “she will say outright that she is not a fan” of bitcoin, saying that many of the transactions that “do take place on bitcoin are illegal, illicit transactions.” She has speculated on the “very high” energy usage of bitcoin, as well as cybersecurity concerns around anonymous cryptocurrencies. The Treasury Department contains the Office of the Comptroller of the Currency (OCC), and its leader is designated by the Secretary of the Treasury. The current holder of the office was the Chief Legal Officer of Coinbase, Brian Brooks, someone who had been seen as cryptocurrency-friendly, allowing for USD stablecoin reserves for banks. He will likely be replaced with somebody who is either apathetic to cryptocurrencies or maybe hostile to a certain degree. The US Treasury Department’s Office of Foreign Asset Control can also add cryptocurrency addresses associated with sanctioned individuals to its blacklist. FinCEN is a bureau of the United States Department of the Treasury as well, one with immense powers to enforce against money laundering violations. It’s responsible for enforcing actions against bitcoin mixers and enforcing the Bank Secrecy Act.