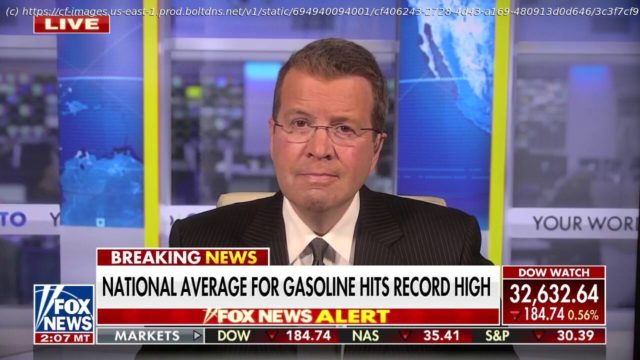

This is a rush transcript of “Your World with Neil Cavuto” on March 8, 2022. This copy may not be in its final form and …

This is a rush transcript of “Your World with Neil Cavuto” on March 8,2022. This copy may not be in its final form and may be updated. NEIL CAVUTO, FOX NEWS ANCHOR: All right, if aren’t getting out of his oil market didn’t woo him, maybe the prospect of doing without Big Macs in Russia will. Welcome, everybody. I’m Neil Cavuto, and this is YOUR WORLD. Well, Joe Biden went ahead and made a major pivot, when he said at first he wasn’t going to ban all Russian oil from this country. Today, he did. And it was sweeping, and it was immediate. And it was already signed. And we got the Brits to do the exact same thing, even though the rest of Europe isn’t too keen on it, and all of this at a time gas prices still advanced and oil prices still advanced. But the hope is they won’t advance as much, and this as we’re learning that more and more American companies are following McDonald’s and saying, well, if you McDonald’s are going to get rid of the Big Mac in Russia, we at Starbucks are going to do the same with our lattes, and Coca-Cola saying with our soda. All of them have abandoned and announced they are abandoning in Russia, in the case of McDonald’s, planning to shut down 850 Russian stores in the process, and all of this at the same time we had a tantalizing offer from the Ukrainian president on what might be a key concession. That’s how some are interpreting, a concession that might end the fighting, the fighting rampant today, though. Russians’ shelling continued to affect people trying to get out of the country. This is for the third time we have seen this type of activity. But record numbers of people are leaving the country, better than two million,200,000-plus a day. We will update you on that. In the meantime, let’s get the latest from Peter Doocy at the White House. Peter, this was a notable shift on the part of the president. Some interpret it as a sign down the road he might shift on something else, like domestic oil production. None of that today, though, right? PETER DOOCY, FOX NEWS WHITE HOUSE CORRESPONDENT: And, Neil, a notable shift just in the few hours. When we heard the president here explaining that he was going to cut off Russian oil imports to the U.S., he explained all the different measures that he thought the U.S. could take to try to limit some of the rising prices at the pump. But just a few minutes ago, he landed in Texas and he made it sound like a lot of this is out of his hands. (BEGIN VIDEO CLIP) JOE BIDEN, PRESIDENT OF THE UNITED STATES: It’s going to go up. Can’t do much right now. Russia is responsible. (END VIDEO CLIP) DOOCY: Can’t do much right now. That’s a few hours after the president said that defending freedom is going to cost us as well. And that is exactly why officials around here had been making it sound like banning Russian oil imports was very unlikely to happen. This was only five days ago: (BEGIN VIDEO CLIP) JEN PSAKI, WHITE HOUSE PRESS SECRETARY: We don’t have a strategic interest in reducing the global supply of energy, and that would raise prices at the gas pump for the American people. (END VIDEO CLIP) DOOCY: The president argued this morning that two big things are going to help, first getting more electric vehicles on roads and winterizing homes so people don’t have to worry about oil prices in the future, second, talking to allies about releasing a combined 60 million barrels of oil from a joint strategic reserve. We also know Biden officials are talking to a trio of countries with spotty human rights records about what it would take for them to pump more oil. That’s Venezuela, Iran and Saudi Arabia. (BEGIN VIDEO CLIP) REP. JIM BANKS (R-IN): Joe Biden plans to put terrorist ahead of Texas, before Texas. (END VIDEO CLIP) DOOCY: The president is in Texas right now. He’s on his way to go speak at an event about veterans who fell ill after exposure to burn pits. We don’t know if we are going to hear him talk again today about Russia — Neil. CAVUTO: Peter, thank you very much. Peter Doocy at the White House. William La Jeunesse is seeing firsthand how people are reacting to the oil prices and the gas prices, high as they are, in fact, in dollar terms, the highest they have ever been, but it’s particularly painful in California, where they heap a lot of taxes on top of that. William, what’s the reaction there? WILLIAM LA JEUNESSE, FOX NEWS CORRESPONDENT: Well, Neil, people are beginning to cut back, right, $6.09 a gallon here in West L.A., $6.99 in Mid City L.A., nationally, about $4.17 a gallon. Now, when President Biden took office, a barrel of crude was about $65. Today, it is $130, the increases at the pump however even more dramatic right, about $1 a gallon in just two weeks. That means less spending on other consumer goods and restaurants, forcing people to make choices. Vacation, maybe not. Slower growth. Yet oil is the number one driver of inflation, right? Anything you would buy, everywhere you go has to absorb that price hike. Caught in the middle, consumers, who yesterday actually crashed the GasBuddy Web site, searching on where they could save a nickel or dime on a gallon of gas. (BEGIN VIDEO CLIP) UNIDENTIFIED MALE: I was in Beverly Hills, and that was like $7 — about like $7.50. So, I drove over here and I was like, yo, I saved $3. UNIDENTIFIED MALE: I need to find another place to — more cheaper. We — yes, that’s how we need to do it. UNIDENTIFIED MALE: I think, that for workers like me that do delivery driving, it makes it almost impossible, because they’re not willing to compensate for a higher wage. So it’s all coming out of my pocket. (END VIDEO CLIP) LA JEUNESSE: Experts say this price spike is driven more over uncertainty and Russia than supply and demand. It’s true prices rallied coming out of the pandemic. Refiners and producers did cut back when everybody worked at home. But with Ukraine, now speculators have jumped in. And now with the U.S. banning those Russian imports, prices here at home reflect the scramble to replace that production, albeit small, with long-haul truckers and families, everyone feeling a little pain at the pump. (BEGIN VIDEO CLIP) JOHN QUELCH, UNIVERSITY OF MIAMI BUSINESS SCHOOL: If everybody sees $4, and then, one month later, they see $5, that’s when it becomes problematic, because it’s not just the level of increase. It’s the speed with which the increase has occurred that makes IT dramatic. (END VIDEO CLIP) LA JEUNESSE: So, how long does this last, Neil? Frankly, nobody knows. What we do know is, prices come down a lot slower than they go up — Neil. CAVUTO: William, that’s a great report, puts it in perspective, but, man, some of those prices, yikes. A lot of times, on this show, we just try to get the facts right. It’s not opinion show. I mean, no one cares what I think, and nor should you. But when I hear information that constantly gets out there and then gets accepted as fact, we’re just here about the facts, just the facts. And for those of a certain reference, it’s sort of like Jack Webb. We just want the facts, the “Dragnet” thing. So when I hear this issue of domestic oil production, and it having no effect on prices, it kind of irks me, because it’s time for a little bit of economics 101 when it comes to oil production. And I think a lot of people could benefit from just getting this straight. This is what got my goat. Take a look. (BEGIN VIDEO CLIP) PSAKI: Keystone was not an oil field. It’s a pipeline. Also, the oil is continuing to flow in, just through other means. So it actually would have nothing to do with the current supply imbalance. The Keystone pipeline has never been operational. It would take years for that to have any impact. The Keystone pipeline was not processing oil through the system. That does not solve any problems. The Keystone pipeline isn’t even really functioning. I mean, it was only partially built. It isn’t even really functioning. So suggesting that changing that would lower the price of gas, I don’t know that makes substantive sense. (END VIDEO CLIP) CAVUTO: All right, I have great respect for Jen Psaki and the people trying to push this argument that the pipeline or domestic production doesn’t weigh in on the price of oil. But the fact of the matter is, and she’s right about this, that, at the time the president essentially shelved Keystone, the prospect of getting oil from it immediately anyway was remote. It was at least a year away to get some oil, years away to get the 830,000 barrels that the administration of Donald Trump was trumpeting at that time. We’re going to talk to his energy secretary about that. But I want to stress here, oil trades on the global markets. It’s like a stock. So it reacts to developments, like it did on January 20, when oil prices jumped and continued jumping. Now, in large part, Ms. Psaki is right to say that a lot of that was the boom we got coming out of a near-stopped economy from the pandemic. Absolutely so. Demand was building and supply seem constrained. But the markets trade on this like they do any stock, not on the news, but on the impact of that news. Let me give you an example. When a company comes out with big earnings, sometimes, folks wonder, gee, then why did the stock sell? Well, because, sometimes, the guidance the company gives, gives the prospect that maybe things won’t be so robust in the future. So it is trading and investors are reacting to that development, not so much the news of the moment or the past, the latest quarterly earnings, but the prospect that things might not be so good. Now, the reverse can oftentimes be true. You have a company report lousy earnings, but convinced that the future looks better, and people bid up the price of that, even though those things it’s forecasting are quite some time off. Oil works the same way. It trades in the open markets, just like stocks. Globally, investors sort of pick and choose what motivates either bidding prices or staying away from it. When this president announced that he was going to stop Keystone production and sent a clear signal that domestic oil production would not be his cup of tea, well, that prompted a lot of traders to see and bid up the price of oil, in the likelihood that at least future supply would be limited. It’s all about markets. There is no cabal here trying to set this. I just want to be very, very clear about this, because we’re about the facts. We’re about the economic reality that affects prices. Now, do sometimes markets go too far? Absolutely. Sometimes, do they get it wrong? Absolutely. Did we in 2008, when we got up to $141 a barrel, bid it up too far too fast? Well, we must have done something, because a financial meltdown followed. And within five or six months, it was down to $31 a barrel. Now, you’re probably saying, Neil, you’re boring us to tears on this. But it is an important economic point I want to raise here. The idea of a pipeline and its effect when it’s shut down, it’s not the prospect of where things stand in the moment, because, as Jen Psaki said, there was no oil coming out of it in the moment, and the big oil supply that would come was still years off. Furthermore, it was supposed to be oil coming from Canada, Alberta, Canada, into this country, meaning that it would lock in North American production of crude we badly need. That was based on the notion that we weren’t going to get that anymore. The markets read into that, all right, there’s certainly a finite supply coming out of the United States. One other footnote on Ms. Psaki before I stop lecturing on this, a great deal of discussion about the 9,000 leases and contracts that the oil industry has. She’s exactly right. What she leaves out is the 37,000 leases the oil industry had just last year. It has exhausted as many of those leases as it can. Oil guys want to make money. God bless them. That’s their right. And some of those leases, they don’t see as productive, or they could take much longer to bear fruition. But they prioritized enough to take close to 40,000 leases on land and whittle it down to 9,000 today. That’s all I wanted to relay here, the real story, what motivates pricing. It’s fear and greed. It’s anticipation. Sometimes, it’s right. Sometimes, it’s wrong. But then there are the facts. And here to help elaborate on them, Gary Kaltbaum, a good market read. Gary, the bottom line is this. We have looked at oil from the prism of limited supply, at least coming from this country, or not as much supply. And now we’re frantically trying to replace oil from Russia with other nefarious alternatives. But the bottom line, it’s about supply that could be a lot bigger here that we’re not tapping here, right? GARY KALTBAUM, FOX BUSINESS CONTRIBUTOR: Neil, if the president surprised the markets today, and said we have changed our stance, and we are going to make sure we are producing 13,14 million barrels a day, you would have seen oil drop $15, $20, maybe even $25 today. Why? Because traders, investors and speculators are leaning big time long right now. They would have to switch gears immediately. And the short sellers would come in. But instead, the same old, same old, and to use the excuse that, oh, it would take time anyhow, meanwhile, they’re touting electric vehicles to all, which will take decades to all, so the illogical continues to rule. And I will tell you the lower-income and the lower-middle-class income families right now are being crushed. Yesterday, on my radio show, I spent three minutes listing 150 products that are made with petroleum. The list is actually 8,000. And that includes solar panels and things like that. I do not think this economy and families can stand if we continue with the $124 oil that we’re at right now. And it looks like nothing’s going to be done here in the United States. And we get the turn to wonderful human beings like Mr. Maduro down in Venezuela. CAVUTO: Well, that is a little weird. (CROSSTALK) CAVUTO: And, certainly, there’s no denying that, coming out of the pandemic, we would see oil prices rise. You’re going from an economy in park to certainly economy that’s moving. KALTBAUM: Sure. CAVUTO: And things are going to jump. And that’s exactly what happened. I get that. Obviously, the Ukraine situation took that to a new level of crisis. But the fact of the matter here, there would be very little damage done just acknowledging that maybe it’s time for a pivot. Maybe it’s time to explore U.S. options here. There are plenty of them. Maybe it’s time to get the pipeline started again, so all of that oil from Alberta, Canada, makes its way here to fill up the supply side of it. The issue now going forward, whether you agree with that or not, is what happens now? Because oil prices still climbing again today, gasoline prices still climbing. The fear is, Gary, they keep climbing like that, it’s going to cause a slowdown in and of itself, the stag in stagflation hits us, and that’s going to then maybe bring lower prices.