We believe as the economic scene unfolds, the economy will weaken, inflation will begin to moderate, the Fed will become less hawkish, and, in an era of “forward guidance,” the markets will reprice bonds to lower yields (higher prices).

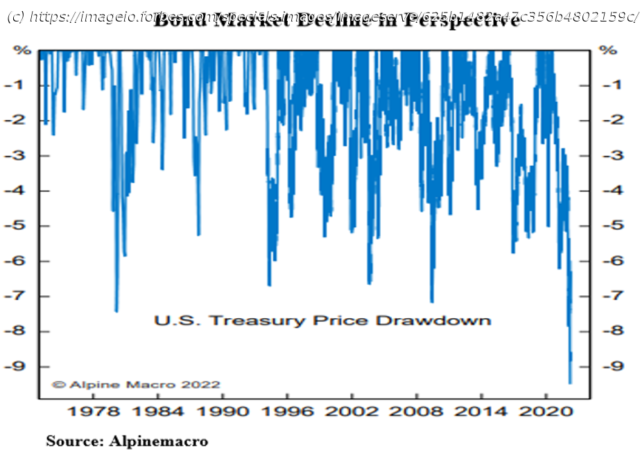

Jim Cramer of CNBC has a saying: “There’s always a bull market somewhere. My job is to help you find it!” Rule #5 of Bob Farrell’s famous 10 Rules for Investing states: “The Public Buys the Most at the Top and the Least at the Bottom.” His Rule #9 says: “When All the Experts Agree, Something Else is Going to Happen.” There is no doubt about it – bonds are the most hated asset class on Wall Street. That’s why all the above axioms apply. Bonds are in a 50-year bear market as seen from the downdraft in bond prices in the chart above. Prior to that sell-off, Wall Street had been pointing to the paltry yields bonds were returning to their holders. TINA (There Is No Alternative) was the resulting acronym. We wonder, after the recent run-up in bond yields, if we will be hearing about a new acronym: TIA! The questions that need to be answered about bonds are: 1) Why such a rapid and deep bond sell-off; and 2) What’s the likelihood that it can go further? As we’ve chronicled in this blog since the Fed’s March meeting when the bond sell-off began in earnest, the bond market has compressed the Fed’s contemplated set of rate hikes over an 18-month period (the “dot-plot”) into a matter of weeks, in effect, immediately tightening financial conditions to that terminal 18-month view. Never mind that the “dot-plot” has a paltry 37% correlation with the resulting reality (because the Fed is “data dependent,” it can change its intentions as the incoming data dictate). In past Fed tightening cycles, “forward guidance” as the dot-plots are now called, did not exist (forward guidance began in 2012). In prior tightening cycles, no one knew what the Fed was going to do until they did it. Since the recent Fed meeting, as inflation has escalated, so has the hawkish rhetoric from Fed governors. That, too, never occurred in past tightening cycles. And, with each of those hawkish utterances, bonds yields have ratcheted higher (prices lower). It isn’t any wonder that everyone hates bonds! Of course it can go further. We don’t know tomorrow’s or next week’s prices or yields.