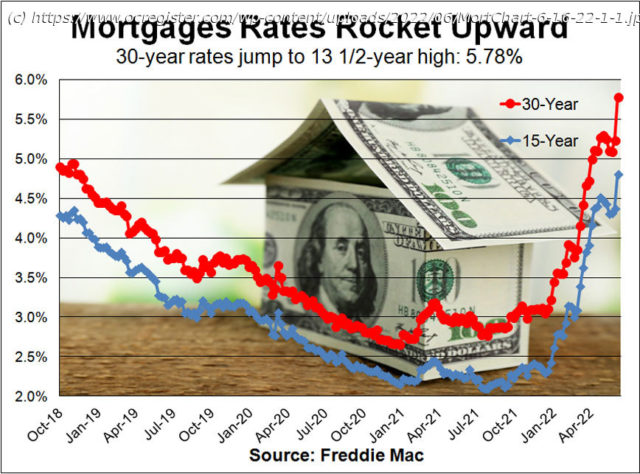

LAZERSON: This week’s 30-year fixed rate jumped to 5.78%, the largest weekly surge in 35 years.

Jeff and Kim Noviello got outbid in their first two offers for the Mission Viejo home they fell in love with at the front door. Two other buyers had higher offers. The third time was the charm, however, as the previous sets of buyers fell out. Escrow closes next week. Mortgage rates and home prices continued to ascend during their five-month effort to find home. Last month, instead of locking their $950,000 loan balance on a 30-year fixed at 5.25%, they opted for a 10-year adjustable-rate mortgage fixed at a 4% rate (30-year term). At 4%, their principal and interest payment is $4,535, compared with a $5,246 payment at 5.25%. That’s a $711 monthly savings, or nearly a 15%. That’s one way to beat inflation. The 4% rate kept their payments within their monthly budget. They plan to transition to a fixed rate down the road when rates drop.

“Everyone I know is in the mortgage biz, and they were telling me not to do an ARM,” said Jeff Noviello, a client of mine. But the fixed-rate alternative has gotten way too costly. Mortgage rates exploded this week. The average Freddie Mac rate climbed 55 basis points from last week’s 5.23% rate, landing at 5.78%. That’s the highest 30-year rate since Nov. 28, 2008, and the fifth biggest one-week jump in records dating back to 1971. (The biggest was 140 basis points in March 1980.)

No doubt homebuyers are pressing and stressing about mortgage qualifying and being able to personally afford the monthly house payments for a home with the features and amenities they want. Mortgage payments jumped 35% since the start of the year, when 30-year rates averaged 3.22%. The principal and interest payment for a $647,200 mortgage (the maximum conforming loan amount) was $2,806, compared with $3,789 this week.

Домой

United States

USA — Financial Adjustable-rate mortgages can lower payments as interest rates soar