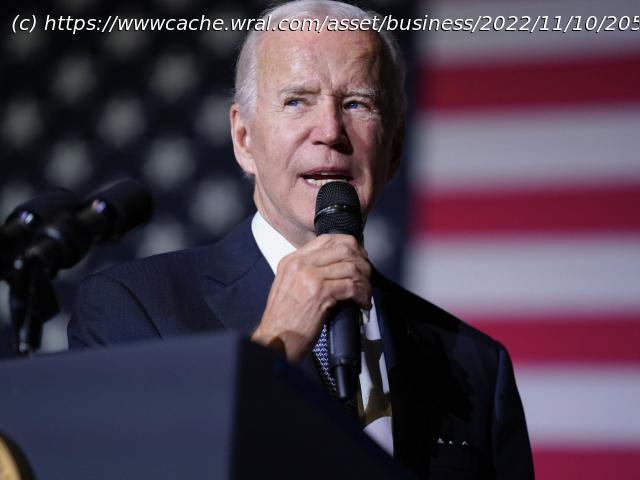

President Joe Biden’s plan to provide millions of borrowers with up to $20,000 apiece in federal student-loan forgiveness has been blocked by a second federal court, leaving millions of borrowers to wonder if they’ll get debt relief at all.

President Joe Biden’s plan to provide millions of borrowers with up to $20,000 apiece in federal student-loan forgiveness has been blocked by a second federal court, leaving millions of borrowers to wonder if they’ll get debt relief at all.

President Joe Biden’s plan to provide millions of borrowers with up to $20,000 apiece in federal student-loan forgiveness has been blocked by a second federal court, leaving millions of borrowers to wonder if they’ll get debt relief at all.

On Thursday, U.S. District Judge Mark Pittman ruled that the program usurped Congress’ power to make laws. The administration immediately filed a notice to appeal.

It’s not the only challenge the plan faces. Last month, the 8th U.S. Circuit Court of Appeals in St. Louis put loan forgiveness on temporary hold while it considers a challenge from six Republican-led states.

The fate of the plan will likely eventually end up in the Supreme Court, meaning a final decision is a ways off.

Here’s where things currently stand:

HOW THE FORGIVENESS PLAN WORKS

The debt forgiveness plan announced in August would cancel $10,000 in student loan debt for those making less than $125,000 or households with less than $250,000 in income. Pell Grant recipients, who typically demonstrate more financial need, would get an additional $10,000 in debt forgiven.

Current college students qualify if their loans were disbursed before July 1. The plan makes 43 million borrowers eligible for some debt forgiveness, with 20 million who could get their debt erased entirely, according to the administration.

The Congressional Budget Office has said the program will cost about $400 billion over the next three decades.

THE POLITICAL FALLOUT

The program immediately became a major political issue ahead of the November midterm elections. Republican lawmakers and other conservatives called it an unfair government giveaway for relatively affluent people at the expense of taxpayers who didn’t pursue higher education.

Biden responded by calling critics’ outrage “wrong” and « hypocritical.” He noted that some Republican officials had their own debt and pandemic relief loans forgiven. Still, many Democratic lawmakers facing tough reelection contests distanced themselves from the plan.

THE TEXAS CASE

Pittman — an appointee of former President Donald Trump based in Fort Worth, Texas — made it clear that he felt Biden overstepped his authority. He said the Higher Education Relief Opportunities for Students Act of 2003, commonly known as the HEROES Act, did not provide the authorization for the loan forgiveness program that the administration claimed it did.

The law allows the secretary of education to waive or modify terms of federal student loans in times of war or national emergency. The administration claimed the COVID-19 pandemic created a national emergency.