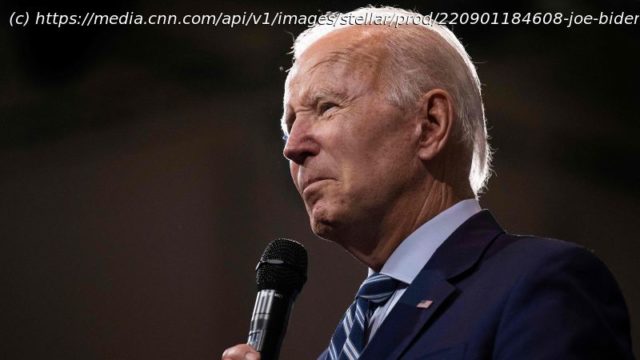

Student loan borrowers are now waiting indefinitely to see if they’ll receive debt relief under President Joe Biden’s student loan forgiveness program after a federal judge in Texas struck down the program on November 10, declaring it illegal.

Student loan borrowers are now waiting indefinitely to see if they’ll receive debt relief under President Joe Biden’s student loan forgiveness program after a federal judge in Texas struck down the program on November 10, declaring it illegal.

The Department of Justice immediately appealed to the 5th US Circuit Court of Appeals. But that case will have to play out before the Biden administration can cancel any federal student loan debt under the program.

While the Biden administration has faced several legal challenges to the student loan forgiveness program since it was announced in August, the November 10 ruling is the most significant setback thus far – prompting the Department of Education to stop accepting applications for debt relief.

Biden’s program was already on hold due to a separate legal challenge before the 8th US Circuit Court of Appeals, but the administration had continued accepting applications, having received 26 million to date.

Under the rules of the program, eligible low- and middle-income borrowers can receive up to $10,000 of federal student loan forgiveness and up to $20,000 in cancellation if they also received a Pell grant while enrolled in college.

The legal road ahead is murky, but it could take many months for the issue to be resolved.

The Texas decision “makes it more likely that the issue will ultimately go to the Supreme Court, though it is still too early to say,” said Abby Shafroth, staff attorney at the National Consumer Law Center.

Four days after the Texas decision, the 8th US Circuit Court of Appeals dealt another legal blow to Biden’s program, granting a request for a preliminary injunction sought by plaintiffs in a separate lawsuit. The November 14 ruling does not change the status quo for borrowers since the program was already halted.

The Justice Department has signaled that it plans to ask the Supreme Court to step in and vacate the 8th Circuit Court’s injunction.

Borrowers will have to wait for the lawsuits to play out. While it can be tough to follow all the various legal challenges, borrowers can subscribe for updates from the Department of Education and check the Federal Student Aid website for further information.

It could take months for the legal challenges to be resolved. If it overturns the Texas lower court’s ruling, then the Biden administration could begin canceling student debt.

Initially, the Biden administration said that it would start granting student loan forgiveness before payments are set to resume in January after a years-long pandemic pause.

But the November 10 ruling in Texas puts that timeline in jeopardy.

“For the 26 million borrowers who have already given the Department of Education the necessary information to be considered for debt relief – 16 million of whom have already been approved for relief – the Department will hold onto their information so it can quickly process their relief once we prevail in court,” said White House press secretary Karine Jean-Pierre in a statement following the Texas ruling.