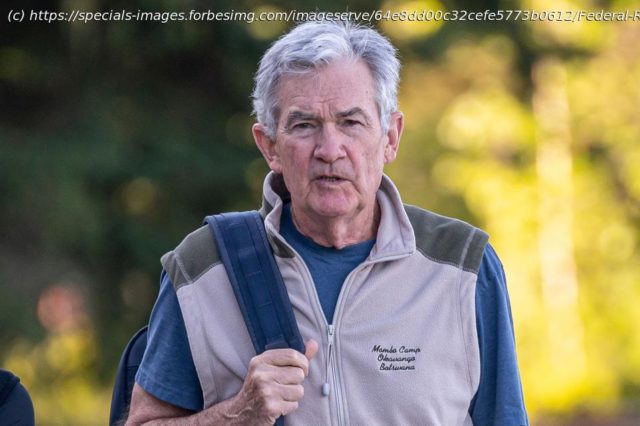

Federal Reserve Chair Powell reinforced that U.S. interest rates could remain high for some time, with a chance housing and wage data push rates up.

Federal Reserve Chair Jerome Powell’s speech on August 25 suggested interest rates are likely to remain high for some time. Perhaps a greater concern for markets is that Powell’s assessment that either economic growth needs to slow, notably with regard to subdued home prices and softening wage growth, or interest rates might need to rise further to stamp out residual inflation. If home prices rebound or wage growth doesn’t slow, we could see further interest rate hikes, perhaps in the next two months.

That said, Powell saw some positive inflation trends, these just haven’t been sustained enough to call inflation beaten. Still, consistent with other speeches from the Fed Chair, it was not a particularly optimistic outlook.The Verdict On Inflation

In breaking down inflation trends, Powell sees the prices for physically goods, such as cars, trending favorably and helping bring inflation lower. Housing too is likely to see easing prices in Powell’s view. That’s because the Fed looks at lease costs, which move with a lag to home prices, so there are some disinflationary trends in the pipeline. There’s an expectation that recent declines in home prices may take time to work into the inflation data.

However, despite broadly positive trends in these two categories, Powell remains concerned about services inflation fueled by wage growth.