While monetary policy (the Fed) is working hard to slow the economy and control inflation, the fiscal authority (the Treasury and the Administration) is doing the oppo.

While monetary policy (the Fed) is working hard to slow the economy and control inflation, the fiscal authority (the Treasury and the Administration) is doing the opposite. According to the Wall Street Journal (“A Peacetime Fiscal Blowout” – August 9th), the largest expense line item increase in the federal budget was interest on the debt. For fiscal ’23, it has risen by $146 billion (34%) to $572 billion and is likely to rise to near $675 billion before the fiscal year ends on September 30. That’s nearly half the federal budget. Even if the budget became balanced, interest expenses are only going to rise as the Treasury refinances the low-cost existing debt as it matures over the next few years. This is true, not only for the federal government, but for state and local government entities and for most of America’s publicly traded companies. Those significantly higher debt costs are sure to slow economic growth, if not kill it altogether. Such growth is already challenged by demographics (retiring baby boomers).

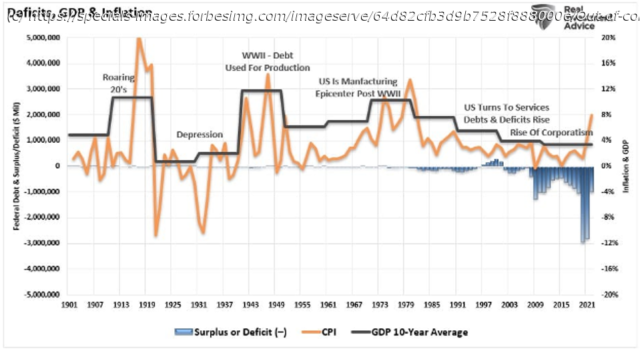

Note on the chart at the top that out-of-control deficits (blue bars) didn’t occur until the Great Recession in 2009, but, unlike in the past, they didn’t stop once the economy healed. Then came the pandemic and two years of real blowout deficits. Note the spike in inflation (gold line) during that time. Apparently, inflation was the price to pay for all that largesse and free money! But, despite an economy where folks in Washington D.C. are patting themselves on the back because they think the economy will have a “soft-landing,” the deficits now appear to be on automatic and completely out of control. The chart below shows federal interest payments as a percentage of nominal GDP since 1947. Note the recent spike on the far-right hand side. This is only going to get worse.

The U.S. budget deficit is now 6% of GDP and interest payments, as shown on the chart, are 3.6% of nominal GDP. This is occurring at a time when the Unemployment Rate (U3) is 3.5%. Economists agree that an unemployment rate of 4% represents “full-employment”. In Econ 101, students are taught that fiscal policy should be counter-cyclical, meaning that when the economy is at full-employment (4% or lower) there shouldn’t be a deficit – perhaps, even a surplus. But, as you can see from the chart at the top, it’s been quite a while since we have had a budget surplus.

On August 22nd, a new currency unit sponsored by China, Russia, Brazil, India etc., 100% backed by gold, will debut. (No wonder China has been stockpiling gold for the past year!) With the U.S running banana republic-like deficits, we wonder how long before the world adopts the new currency as its reserve currency. There doesn’t have to be a declaration of such – it will happen when self-interest seeking parties decide that the new currency is “safer” than the dollar. May happen sooner than expected!Inflation Adieu

In our last few blogs, we indicated that the July rate of inflation (on a year over year basis) was going to rise above June’ 3.0% rate. So, July’s 3.3% inflation rate didn’t surprise us. Since the Fed seems to be wed to the 12-month lookback in determining policy, there is now a danger that, at their September meeting, they raise rates again based on both the July and August CPI readings as August’s reading will likely remain in that 3.