OPINION: Not even dynamic scoring can make this tax bill look like anything other than what it is — generational theft.

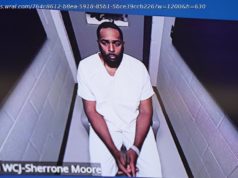

House

Speaker Paul Ryan and Senate Majority Leader Mitch

McConnell Pablo Martinez

Monsivais/Getty Images

In Washington, there’s a magical way to make a budget look

balanced even when it’s not — it’s called „dynamic scoring.“

Basically, it allows bean counters to use growth projections to

offset income lost from tax cuts.

Dynamic scoring involves using economic models that supposedly

show the effects of fiscal policy like a tax cut on growth. The

idea is that a tax cut, by putting more money in investors‘ and

consumers‘ pockets, can add more juice to the economy, helping to

make up for larger deficits caused by lost tax revenue.

And since the 1980s, when a bunch of the GOP legislators

currently trying to ram the Tax Cuts and Jobs Act down

America’s throat were much younger people, it has been a bandaid

on budget-busting bills — using generous projections to show

increased economic growth generated by tax cuts that would help

the cuts pay for themselves.

That’s called getting something for nothing, and if that’s not

magic I don’t know what is. Unfortunately, this time around the

Tax Policy Center (TPC) estimates that not even the magic of

dynamic scoring can make this tax bill look good. It simply does

not generate enough economic growth to make up for lost revenue

from the cuts.

„We find the legislation would boost US gross domestic

product (GDP) 0.7 percent in 2018, have little effect on GDP in

2027, and boost GDP 0.1 percent in 2037,“ the TPC report

said.

Using regular math, and not the magical math of dynamic

scoring, the Senate Finance bill would increase deficits by about

$1.4 trillion from 2018 through 2027, TPC said. Around 2028 some

of the tax breaks for individuals start to expire, and then „the

bill would reduce deficits by about $174 billion before taking

into account macroeconomic effects and extra interest.“

Throw dynamic scoring into the mix and the bill’s cost only

goes down by an additional $34 billion. That results in a „small

net decline in deficits of about $208 billion over the second 10

years,“ according to TPC.

In other words, not even magic can make this bill

revenue-neutral. Even generous models show it will add to the

deficit, and add to the debt burden future (and some current)

American tax payers have to take on.

Tax Policy

Center

The TPC reasons that the tax cut will boost demand from

households a bit in the short run, but since the labor market is

almost at full employment, that won’t be anything to write home

about. It could also boost the labor supply temporarily too — but

only temporarily since those benefits will “ be reversed

after nearly all individual income tax provisions expire in

2025,“ causing most individuals‘ taxes to go up.

Corporations will get to keep their tax break, but once

deficits go up, the TPC says that high interest rates could

temper their investments.

„…all these models tell roughly the same story: The Tax

Cuts and Jobs Act won’t produce dramatic increases in the economy

nor would it come close to paying for itself,“ the report

concluded.

This goes against what Treasury Secretary Steve Mnuchin said to

Congress back in January.

„We do believe in dynamic scoring and, with the appropriate

growth, I think we want to make sure that tax reform doesn’t

increase the deficit,“ he said.

Of course, maybe he didn’t realize what the tax bill would do

since his office never actually produced an

analysis of its economic effects. We imagine the task

would have taken too much time away from critical

Bond-villain-role-playing/arm-length-leather-glove-shopping time

with his wife.

We wouldn’t want that.

Jacquelyn Martin/AP

Last year around this time I wrote that Trump would try

to use

this budget trick to steal from an entire generation. I was

right, but I didn’t realize how ugly this would be. I didn’t

realize how little anyone in the GOP would care about even

appearing to avoid adding to the national debt.

One thing is putting lipstick on a pig. Another is realizing the

lipstick keeps melting off of its snout and saying — oh

whatever, Wilbur still looks ready for the county fair. Pack him

up, no one will notice.

Dynamic scoring doesn’t go far enough to plug the holes in this

tax bill, but since no one in the GOP actually cares about the

appearance of fiscal responsibility, the administration might as

well have not even bothered to use it.