As more signs emerge that the economy is weakening most of the major averages, even the NYSE Composite, made a new high last week. Some technical measures are approaching high-risk levels and Tom Aspray wonders how stocks might react if there is finally a stimulus bill.

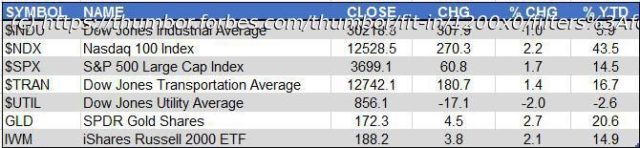

More records for the major market indices, which have started off December on a strong note. The initial sales data from Black Friday and Cyber Monday were supportive. For Black Friday, online sales surged over 20%, which helped offset the sharp decline recorded for in-store sales. Even the upward move in bond yields did not deter the stock market bulls last week, as the 10 Year T-Note reached its highest yield since last March. It was another strong week for the small-cap iShares Russell 2000 (IWM), which was up 2.1% and made another new high. New highs were also recorded for most of the market averages, including the Nasdaq 100, which was up 2.2% and is now up 43.5% year-to-date (YTD). Even though the S&P 500 also made a new high and gained 1.7% for the week, it is only up 14.4% YTD. The 2% decline in the Dow Jones Utility Average dropped it clearly into negative territory for the year. The SPDR Gold Shares (GLD) had a nice rebound last week after the recent sharp decline. The recent increase in the yield on the 10 Year T-Note has not helped gold prices. Historically there have been a number of times when an increase in yields, after a long decline, have pressured gold, which is then viewed as a non-performing asset. The 10 Year T-Note yield peaked in October 2018 at over 3% (line b) as gold was bottoming around $1200. For the next year, yields declined more sharply than gold rose. In June 2019, gold moved above multi-year resistance (line a). As gold formed a short-term peak in September 2019, yields bottomed and rallied into the end of the year (section c). During this period gold had a multi-week correction and then bottomed in December and resumed its positive trend. This coincided with another move lower in yields that culminated in the March 2020 lows. Gold prices peaked in August (line d) as yields made a low before turning higher. So was this a change in the major trend for either gold or the 10 Year Yield? The Comex Gold futures had a low last week of $1767.