The nation has been captivated by revelations of millions of amateur traders collectively through social media and online trading platforms taking on Wall Street’s highest cost, highest risk, most secretive money managers and winning—at least in the short term.

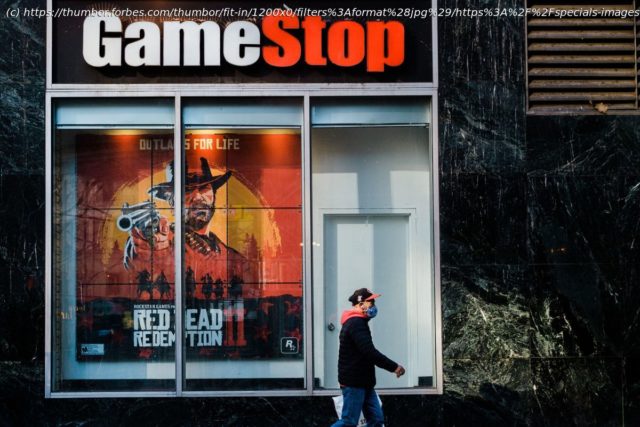

The nation has been captivated by revelations of millions of amateur traders collectively through social media and online trading platforms taking on Wall Street’s highest cost, highest risk, most secretive money managers and winning—at least in the short term. These individual investors have piled into a David-versus-Goliath trade around the stock of GameStop GME, a troubled video game retailer. Hedge funds and other professional money managers were shorting GameStop’s shares, betting that its stock would fall in value while retail investors were banding together to buy shares and options betting the stock would go up. The consensus seems to be that retail investors should not be banding together and gambling their hard-earned savings in this way and the SEC has said it is “actively monitoring the ongoing market volatility.” If you’re a taxpayer or a government worker depending upon a state pension fund for your retirement security, you may be alarmed to learn that nearly all state pensions engage in high-risk strategies, including shorting stocks like Gamestop all the time.

Start

United States

USA — Financial Your State Pension Is Unknowingly Shorting Stocks Like GameStop All The Time