Array

There are 10 global central banks set to make interest rate decisions in the coming days, but today, all eyes are on the Federal Reserve.

I’m Phil Rosen, writing to you just blocks away from the Fed’s building in downtown Manhattan.

New York Stock Exchange senior market strategist Michael Reinking put it well: „Central Bank Week is not quite as popular as Shark Week but it’s starting to have a somewhat similar feel, with traders beginning to smell some blood in the water.“

Today, I’m breaking down what to know about the Fed’s third jumbo rate hike, and how markets could look in its aftermath.

This post first appeared in 10 Before the Opening Bell, a newsletter by Insider that brings you the inside scoop on what traders are talking about — delivered daily to your inbox. Sign up here. Download Insider’s app here.

1. A third, outsized rate hike is an unprecedented move by the Federal Reserve. But extraordinary inflation calls for extraordinary measures.

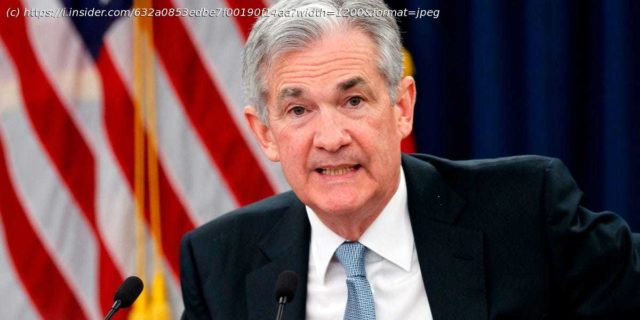

August’s hot Consumer Price Index report dashed hopes that the Fed could soon ease up on its hawkish policy, and Jerome Powell has reiterated his commitment to get prices under control as inflation remains 8.3% higher than a year ago.

Mimi Duff, managing director at GenTrust, told me that Powell will have to try and avoid a 1980s Volcker-esque mistake that sent the economy into a recession.

„Powell wants to be more predictable [than Volcker], and needs to see clear and convincing evidence of inflation coming down,“ she said. „To do this, rates need to be in restrictive territory and stay there for a while.“

While Duff doesn’t expect markets to react too dramatically to a 75-basis-point move, since it’s largely been priced in already, she did note that the threat of further jumbo moves could pressure stocks.

Powell is tasked with the balancing act of stabilizing prices while not tipping the economy into a full-blown recession. GenTrust puts the odds of a hard-landing at 25%, with three-in-four odds of an economic downturn.