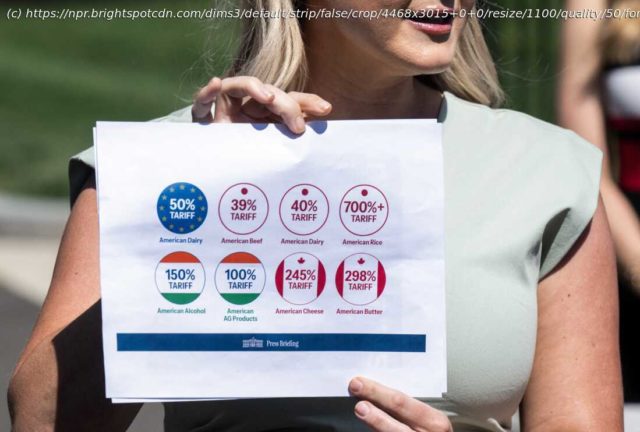

President Trump has been promising new „reciprocal tariffs“ to punish other countries for their tariffs and trade barriers. Markets are nervous that a trade war could hike prices and hurt the economy.

President Trump is set to unveil what he has been calling „reciprocal tariffs“ — taxes on imported goods from a broad range of countries aimed at penalizing them for their trade barriers.

It’s a push he is branding as „Liberation Day“, promising it will bring in foreign tariff revenues to be put toward U.S. tax cuts and deficit reduction, and spur a renaissance in U.S. manufacturing.

But the pledge has glossed over the pain expected to be felt by U.S. consumers who economists expect will end up paying higher prices — and by U.S. farmers and exporters targeted for retaliation by other countries.

Some U.S. manufacturers will be hurt by higher costs for imported materials. And mainstream economists are skeptical that the tariffs will bring in as much revenue as Trump has promised.

While details on his plans are sketchy, the Yale Budget Lab estimated the scheme could cost the average American consumer $2,700-$3,400 per year.

The uncertainty over the policy has roiled the economy. The S&P 500 stock index just closed out its worst quarter since 2022, and consumer confidence recently hit a 12-year low.

Trump had vowed that the tariffs will mirror what other countries impose on U.S. goods. But lately, he has appeared to moderate his tone.

„They took advantage of us“, Trump told reporters on Monday. „And we are going to be very nice by comparison to what they were. The numbers will be lower than what they’ve been charging us and, in some cases, maybe substantially lower.“Few details about what countries, what products will be hit

Trump’s economic policy has been unique not only in his aggressive rhetoric around tariffs but also in the vagueness and unpredictability surrounding his policy announcements.

Start

United States

USA — Financial Today is Trump's 'Liberation Day.' What does that mean for tariffs?