Markets slipped Tuesday as investors await key GDP, Fed, and earnings reports. Meta and Microsoft headline tech, while jobs data and inflation figures loom ahead.

Key Takeaways

Markets dip as investors await GDP, Fed, and earnings

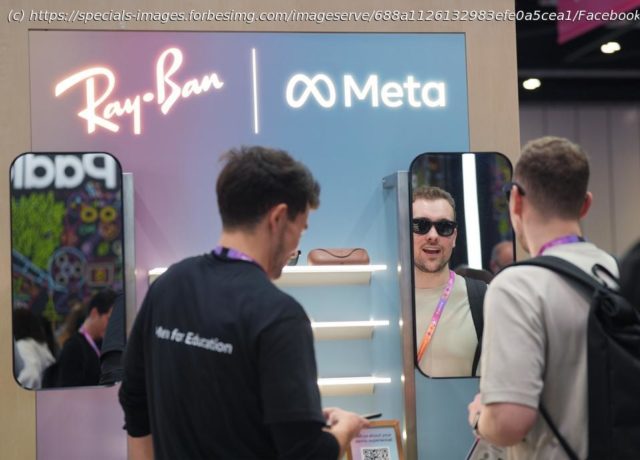

Microsoft, Meta earnings key for AI and cloud momentum

JOLTS weak; PCE and jobs data still to come

The S&P 500 snapped a six-day win streak, closing lower on Tuesday by 0.3%. All the major indices were down on the day. The Nasdaq Composite fell 0.4%. Small caps were the worst performers, dropping 0.6%, while the Dow Jones Industrial Average lost 0.5%. Volume was on the lighter side, but if this week is the equivalent of a thriller movie, the previews just ended.

The lone important economic number released today was the JOLTS figure, which represents the number of job openings. According to Bloomberg, economists were expecting 7.51 million jobs. The actual number was slightly weaker at 7.437 million. By itself, that report doesn’t tell us too much; however, later this week, we’ll get the latest report on employment and that is one I’ll be paying close attention to. More on that coming up.

We also had a couple of earnings reports after the close yesterday that are worth covering. Starbucks missed on same store sales here in the U.S. However, the company did report its first sales gains in China since 2023, sending the stock higher by 3% in after hours. Visa also reported their earnings, missing on income but beating on revenues.