The

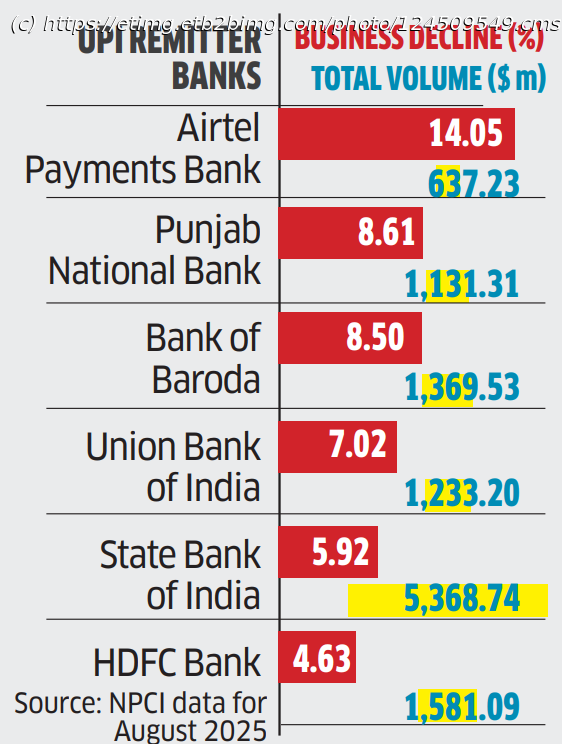

He added that even for Unified Payments Interface (UPI) users inputting a wrong personal identification number (PIN) is very common, which can be addressed through biometric authentication.Data from the National Payments Corporation of India (NPCI) shows that major banks operate at a success rate of 93-95% on UPI. Business declines are the major reasons for transaction failures, followed by technical declines.Business declines are due to factors such as lack of funds and dormant accounts. Technical declines are usually due to entering the wrong PIN or some backend issues.“The impact (of this move) will likely be most pronounced in card transactions, where a chunk of failures is because of friction points, which biometrics can effectively address,” said Bipin Preet Singh, CEO, Mobikwik.While most of the large payment aggregators have launched biometric-based authentication, card companies like Visa are doubling down on passkeys as the second factor. It is a biometric system which generates a token for each consumer that is unique to the specific device and gets invoked every time there is a payment.“With Visa Payment Passkey, every authentication is signed using a hardware-protected private key paired with a public key registered with Visa.

Start

United States

USA — IT Digital payments eye sharper success rates as biometrics, passkeys replace OTPs