U.S. market rally extends as investors weigh sector leadership, economic shifts, and the durability of gains amid evolving conditions.

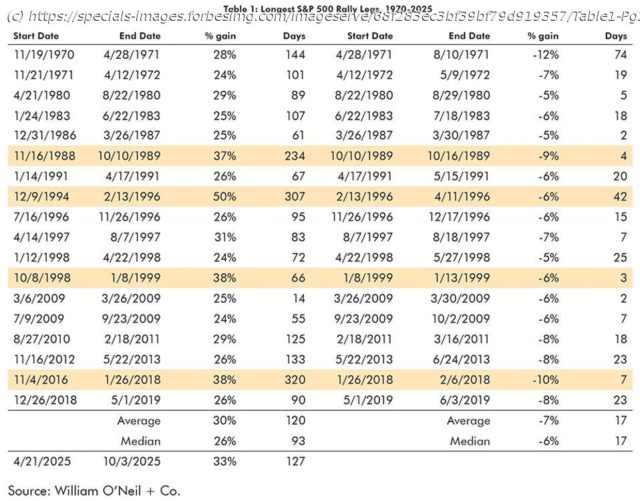

As we have discussed previously, the current U.S. stock market rally that began in April has reached record strength. It has far exceeded the average rally leg of ~14% before a greater than 5% correction. In fact, the S&P 500 is now enjoying its fifth-largest rally without a 5% or greater correction in over 55 years.

Below, we will take a closer look at the prior four legs that showed larger magnitude moves than the current up leg. Three were significantly longer, while the fourth was a sharp but brief up leg.

Each leg started below the 200-DMA, except in 2016, where the rally began directly from the 200-DMA.

Moderate pullbacks of 3–4% were common in these long legs. The key was the index holding above or breaking but quickly retaking the 50-DMA within a few days to sustain the streak.