California’s pension systems should be more cautious about taking risks with taxpayers‘ money and workers‘ retirement benefits.

California’s public pension plans are taking on more risk than other pension systems while generating relatively poor investment return results, a new Reason Foundation report finds. The California Public Employees’ Retirement System (CalPERS) and California State Teachers’ Retirement System (CalSTRS) are the nation’s two largest government-run pension funds, overseeing $558 billion and $382 billion in assets, respectively.

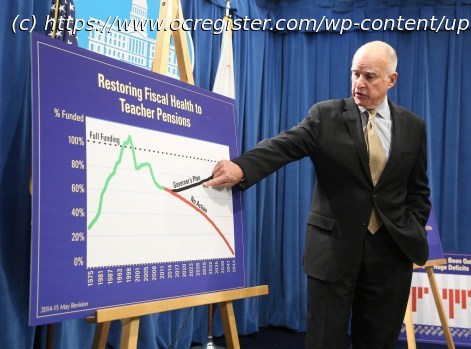

As it stands, California’s state and local governments have the most public pension debt in the country, with total unfunded pension liabilities of more than $265 billion, according to a new report from the Reason Foundation. That’s over $6,000 in pension debt for every state resident. CalPERS has $166 billion in debt, and CalSTRS has $39 billion in unfunded liabilities.

Since pension benefits promised to government workers are constitutionally protected, taxpayers are on the hook for that debt. In the years ahead, paying this pension debt will consume an ever-larger portion of state and local budgets.

So, to pay for retirement promises already made to government workers while also hoping to keep costs down, public pension systems are chasing new investment return strategies and targets. Worryingly, California’s over-reliance on high-risk, high-return strategies could result in overwhelming losses, a burden that taxpayers would ultimately bear.

Start

United States

USA — Financial California’s state and local pension plans have over $265 billion in debt