The inflation rate is starting to ease, but the latest CPI report shows the US is still a long way from the Federal Reserve’s goal.

Although inflation is still running uncomfortably high and many Americans are struggling to keep up with rising prices, new data showed that price gains eased last month.

In October, prices rose 7.7 percent from a year before, according to a Consumer Price Index report released on Thursday. That’s slightly down from the previous month, when prices were up 8.2 percent. Prices rose 0.4 percent from September to October, the same rate as the previous month.

The CPI report is closely watched by the Federal Reserve, which has aggressively raised interest rates since March to bring inflation under control. Thursday’s report could be encouraging news for the Fed, but officials have repeatedly said inflation is still too high.

The Fed’s goal is to keep prices stable, ideally with inflation levels at about 2 percent annually over time. It isn’t to reverse inflation: the central bank is wary of deflation, or falling price levels, which can hurt economic growth. If overall prices are declining, consumers could pull back on spending because they expect costs will be lower in the future. Decreased spending could lead to a slowdown in hiring and business investment, meaning that more workers could be laid off and wage gains could slow.

If Americans can instead expect prices to rise at a stable and low rate of around 2 percent, they can make better financial plans. But with inflation running at its highest levels in 40 years, the United States is still a long way from that goal.

So how do policymakers determine whether inflation is getting better? Although much attention is focused on the CPI report, the Fed’s preferred measure of inflation is actually the price index for Personal Consumption Expenditures, which covers a broader range of spending and is produced monthly by the Bureau of Economic Analysis.

The CPI index captures what consumers pay out-of-pocket for goods and services, while the PCE index covers spending by and on behalf of households, which includes nonprofit institutions that provide services to households. For example, that means that health care costs in the PCE index reflect consumers’ out-of-pocket expenses as well as costs covered by employer-provided insurance and government programs, while the CPI index only covers the direct costs to consumers. So in the PCE index, health care has a greater weight.

The central bank also considers average inflation over longer periods of time — ranging from a few months to a year or longer — because month-to-month data can bounce around. And beyond the headline inflation number, the Fed looks at subcategories in the data to determine whether price changes are temporary or longer-lasting.

One important measure is “core” inflation, which excludes volatile food and energy prices. Economists closely watch “core” inflation

Food and energy prices can dramatically move up or down each month and might not reflect longer-term price trends, since those changes could be a result of temporary factors and reverse relatively quickly. If the Fed only looked at overall inflation, officials might think that general prices are rising or falling more rapidly than they really are. In October, core CPI rose 0.3 percent, down from 0.6 percent the month before. (In September, core PCE rose 0.5 percent from the month before.)

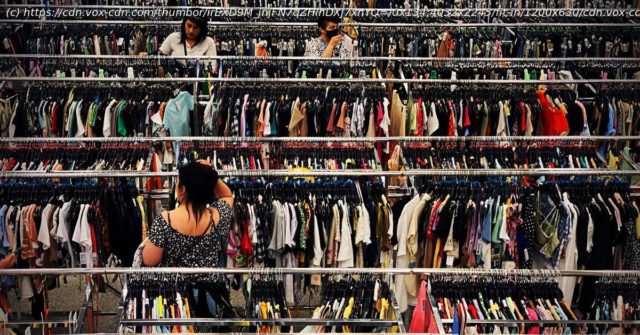

Economists are closely watching what happens to core goods and core services, said Julia Coronado, the president and founder of MacroPolicy Perspectives. Earlier during the pandemic, consumers ramped up spending on goods like exercise bikes and work-from-home equipment. The spike in demand for goods, along with supply chain disruptions, helped lead to the rapid run-up in prices.

Now, consumers are shifting spending away from goods and back to services, which has resulted in price gains for goods starting to cool, Coronado said.