Italy’s Luxottica and France’s Essilor have agreed a 46-billion euro ($49 billion) merger deal to create a global powerhouse in the eyewear industry, two sources with knowledge of the matter said.

Italy’s Luxottica and France’s Essilor have agreed a 46-billion euro ($49 billion) merger deal to create a global powerhouse in the eyewear industry, two sources with knowledge of the matter said.

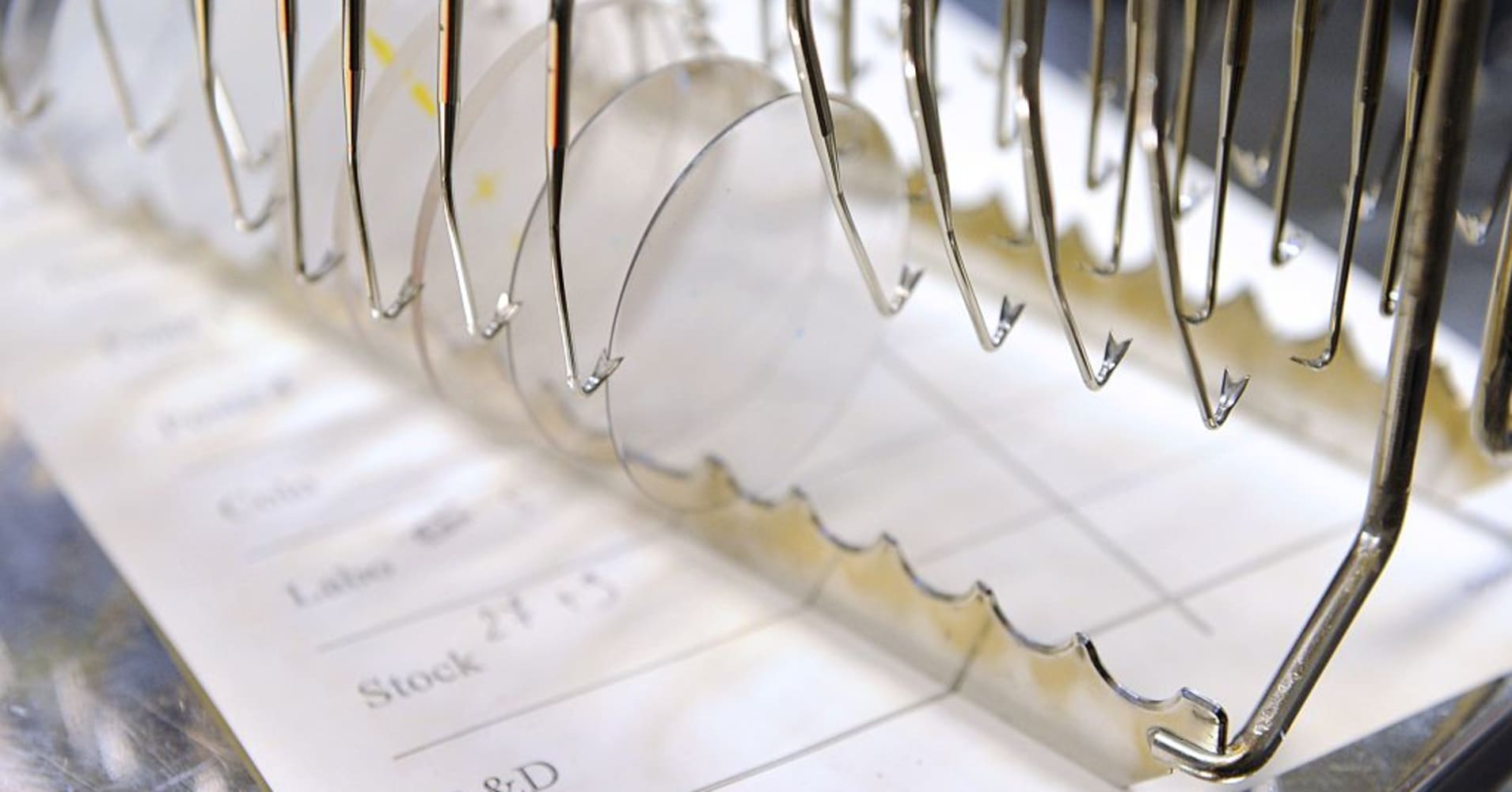

The deal, one of Europe’s largest cross-border tie-ups, is expected to be announced before the market opens on Monday. It brings together Luxottica, the world’s top spectacles maker with brands such as Oakley and Ray Ban, with Essilor, the world’s leading manufacturer of ophthalmic lenses.

The deal will see Luxottica’s 81-year old founder, Leonardo Del Vecchio, take a 31 percent stake in the merged group through his family holding Delfin, becoming the biggest shareholder in the company, one of the sources said.

That source described the tie-up as a « merger of equals. » Luxottica has a market value of around 24 billion euros, compared to Essilor’s 22 billion euros, giving the merged group a combined market capitalization of 46 billion euros.

The two companies’ combined revenues totaled nearly 16 billion euros in 2015 and together they employed some 140,000 people.

The second source said the merged group would be headquartered in Paris and listed on the Paris stock exchange.

The fast-growing eyewear market was valued at around $100 billion in 2015, according to U. S.-based market consulting company Grand View Research. It is expected to keep expanding at a healthy pace in coming years because of an ageing population as well as increasing awareness about eye care and vision problems, with Latin America and Asia seen as key markets for growth.

The Financial Times reported that Del Vecchio would become executive chairman of the merged group and Essilor’s chairman and chief executive, Hubert Sagnieres, 60, will become executive vice-chairman.

Luxottica has been dogged by management upheaval in recent years, raising questions over Del Vecchio’s succession plans and strategy. Some insiders have said a merger could help settle such issues.

Luxottica announced in January 2016 the departure of its third chief executive in 17 months when Adil Mehboob-Khan, a former Procter & Gamble executive, stepped down and Del Vecchio tightened his grip on the group by taking on executive powers.

Long-standing CEO Andrea Guerra quit in 2014 following a rift with Del Vecchio. His successor, Enrico Cavatorta, left after only six weeks into the job, also because of differences with Del Vecchio.

Through Delfin, Del Vecchio, who founded Luxottica in 1961, owns 62 percent of the group, which had revenues of 9 billion euros in 2015, according to Luxottica’s website. Fashion designer Giorgio Armani has a 5 percent stake in the Italian group.

Luxottica cut its full-year outlook in July, blaming uncertain markets, as global security threats cloud the outlook for tourism and consumer spending.

The group said in September 2014 that a deal with Essilor had been explored about a year and a half earlier but was not pursued at the time because the right conditions were not in place.

Back then, it cited shareholding governance issues among the reasons why the deal had not gone ahead. In March and April last year, Luxottica denied press reports of a possible tie-up with Essilor and Germany’s Carl Zeiss , saying the only relationship it had with the two groups was that they both were among its suppliers.

Follow CNBC International on Twitter and Facebook .