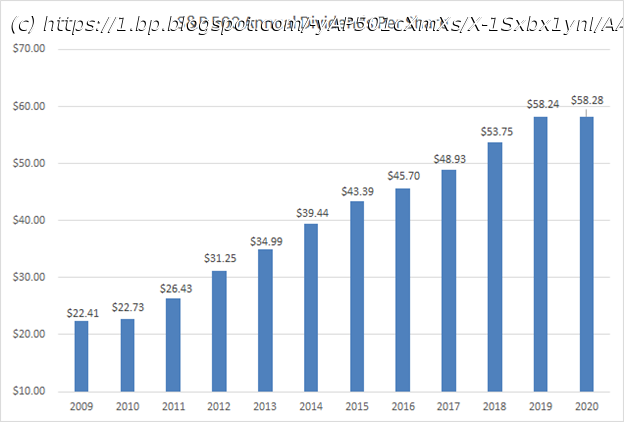

Dividend payments to investors in the S&P 500 rose to a new record in 2020, up 0.7% to $58.28 per share from the previous record

The year 2020 was definitely a turbulent one. It was marked by lockdowns worldwide due to the Covid-19 pandemic, high unemployment and economic turbulence. Yet, it also marks as another record year for US dividend payments, as measured by S&P 500. S&P 500 is a proxy for how US stocks do, since this index of 500 prominent US based companies accounts for 75% – 80% of total stock market capitalization. These are huge companies, with global operations, in 11 industries. Q3 2020 hedge fund letters, conferences and more Dividend payments to investors in the S&P 500 rose to a new record in 2020, up 0.7% to $58.28 per share from the previous record set in 2019, according to research from S&P Global. This marked the eleventh consecutive annual dividend increase for annual dividends on the S&P 500 index. This is due to strong performance in US companies, which expect business to improve over time. The growth in dividends was due to strong first quarter and a strong fourth quarter. While the dividend cuts received a lot of publicity, at the end of the day we ended up with record dividend incomes. This also means that the best dividend fund is probably still the S&P 500. In 2020, there were 423 companies on the S&P 500 that paid a dividend. It is fascinating to see that: You can see the performance by sector broken out in the chart below: It is fascinating to look at how the S&P Dividend Aristocrats did in 2020. There were 61 dividend increases, and only two dividend cuts and one dividend suspension. The dividend suspension was from Ross Stores (ROST), which had just joined the index at the beginning of 2020. The dividend cuts were from Amcor (AMCR) and Raytheon Technologies (RTX). Raytheon Technologies was formed when dividend aristocrat United Technologies (UTX) merged with Raytheon (RTN), and then spun off Otis Elevator (OTIS) and Carrier Global (CARR). The S&P committee also points out to two dividend initiations for the dividend aristocrats index, notably Otis (OTIS) and Carrier Global (CARR).