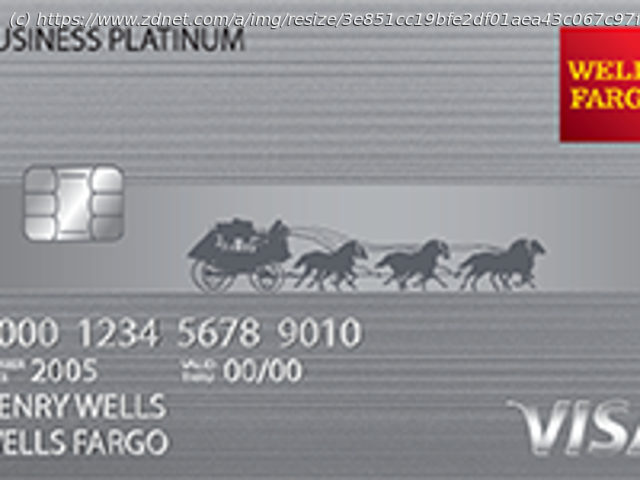

The Wells Fargo Business Platinum Credit Card offers small business holders a credit limit of at least $2,500 and the option to choose from cash back rewards or points for your spending.

Wells Fargo is well-known as a bank that’s friendly to small businesses. It offers business cards for companies at all operating levels. The Business Platinum card is available to business owners who already have a banking relationship with the financial institution and would like to integrate a credit line for added cash flow. Our Wells Fargo Business Platinum 2021 review weighs the card’s main features to help you determine whether it’s worth a spot in your wallet. Wells Fargo business banking customers may find the Business Platinum a good option for capital expenditures. The card comes with no annual fee and the ability to earn rewards on business spending. Business credit cards are similar to personal cards, except for a few extra features that simplify expense management. Here are some of the main features of the Wells Fargo Business Platinum Credit Card: There are many details to consider when choosing a business credit card. Here’s a quick overview of the Wells Fargo Business Platinum Credit Card’s strengths and weaknesses to help you make an informed decision. Unless your small business is well established with credit lines from select stores or vendors, it’s probably difficult to get a credit card that’s secured solely using your company’s financials.