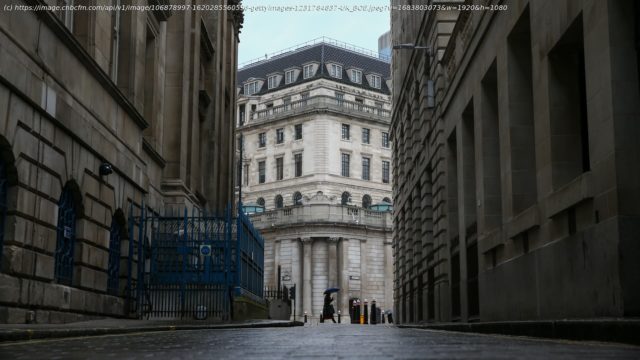

The Bank of England on Thursday hiked interest rates by 25 basis points and upgraded its projections for the U.K. economy.

The Bank of England on Thursday hiked interest rates by 25 basis points and revises its economic projections to now exclude the possibility of a U.K. recession this year.

The Monetary Policy Committee voted 7-2 in favor of the quarter-point hike to take the main Bank rate from 4.25% to 4.5%, as the Bank reiterated its commitment to taming stubbornly high inflation.

The headline consumer price index (CPI) rose by an annual 10.1% in March, driven by persistently high food and energy bills. Core inflation, which excludes volatile food, energy, alcohol and tobacco prices, rose by 5.7% over the 12 months to March, unchanged from February’s annual climb and reiterating the risk of entrenchment that the Bank is concerned about.

The MPC no longer expects the U.K. economy to enter recession this year, according to the updated growth forecasts in its accompanying Monetary Policy Report. U.K. GDP is now expected to be flat over the first half of this year, growing 0.9% by the middle of 2024 and 0.7% by mid-2025. The country’s newest GDP print will be published on May 12.

The economy has thus far shown surprising resilience in fending off a widely-anticipated recession, with falling energy costs and a fiscal boost announced in the government’s Spring Budget improving the outlook.

The MPC now assesses that « the path of demand is likely to be materially stronger than expected in the February Report, albeit still subdued by historical standards. »

« There has been upside news to the near-term outlook for global activity, with U.K.-weighted world GDP now expected to grow at a moderate pace throughout the forecast period, » the MPC said in its May Monetary Policy Report.