Real GDP grew at 2.4% in Q2, and that led the majority of forecasters to join the « soft-landing » camp. But we’re not buying it.

Real GDP grew at 2.4% in Q2, and that led the majority of forecasters to join the “soft-landing” camp. But we’re not buying it. As chronicled by Rosenberg Research, real GDP averages a 2%+ annual rate in the quarter in which the Recession begins, and that includes the Great Financial Crisis (in Q4 2007 GDP grew at +2.2% annual rate). In addition, and of great significance, it is widely known that monetary policy impacts the economy with a long and variable lag; most economists put this lag at 12 to 15 months. Yet despite the fact that much of this past year’s interest rate increases have yet to be felt, this Fed raised rates 25 basis points (.25 pct. points) at last week’s meeting (July 26).

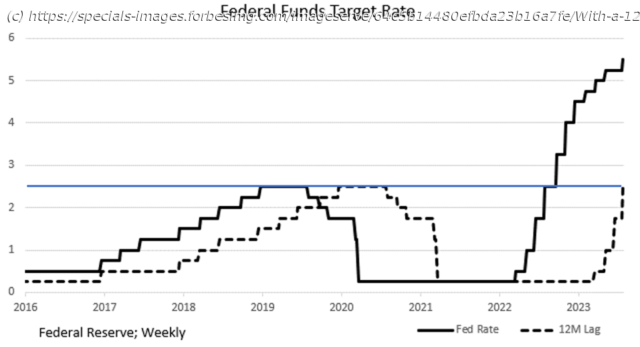

The chart at the top of this blog outlines what this means.

The Fed has told us that the “neutral” Fed Funds interest rate, i.e., the rate that is neither “loose” nor “tight” and has no economic impact, is 2.50%. The blue line in the chart shows “neutral.” Rates above are restrictive, below are accommodative.

The solid black line is the actual path of the Fed Funds rate since 2016.

The dashed line shows the path of that Fed Funds rate with a 12-month lag.

The implication here is that, if monetary policy acts with a 12-month lag, then the dashed line represents monetary policy’s economic impact. Looking at the right-hand side of the chart, one can see that, until now, the effective (12-month lagged) rate has been below the 2.50% neutral rate since the hiking cycle began in March ’22. The Fed didn’t raise its Fed Funds rate above the 2.50% “neutral” rate until late September 2022. As a result, if the 12-month lag is accurate, policy has effectively remained accommodative and won’t turn restrictive until this upcoming September. Hence, the Q2 positive GDP growth shouldn’t come as a surprise. However, a look at the chart shows rapid and accelerating restriction beginning in Q4. Since there are already cracks appear in the economy, the implication is NO SOFT LANDING.Dissecting GDP

The rise in GDP occurred for reasons other than what one would normally expect. Consumer spending only rose 1.6% in Q2 (vs. 4.2% in Q1). Food Services and Accommodation (restaurants and hotels) fell -2.9%, the worst reading since the opening days of the pandemic. Durable goods purchases were flat (0% growth). GDP growth was led by transportation services, i.e., the airlines (+9.8%) as pent-up demand for non-driving vacations was exercised. Thus, the rise in transportation services appears to be a one-time phenomenon.

One area of strength was non-residential construction (+9.7%). The souring international political climate has caused a onshoring of tech related production facilities, especially chip related. Such facilities are quite expensive to build. In addition, state and local governments increased their spending at a 3.6% annual rate in Q2, after a 4.4% rise in Q1. So, the growth in GDP was not caused by the usual suspect (the consumer).Is the Fed Done? – Inflation Trends

We won’t know if the Fed is done raising until their September meeting, and that will likely be decided by the incoming inflation data (as frequently expressed by Chair Powell as the last press conference). Current trends are encouraging, but there are likely to be perception issues going forward. But, first the good news.