The economy has shown signs of weakening as the rate rises have moved toward restriction. Given the lags, “restrictive” policy is about to bite, and bite hard!

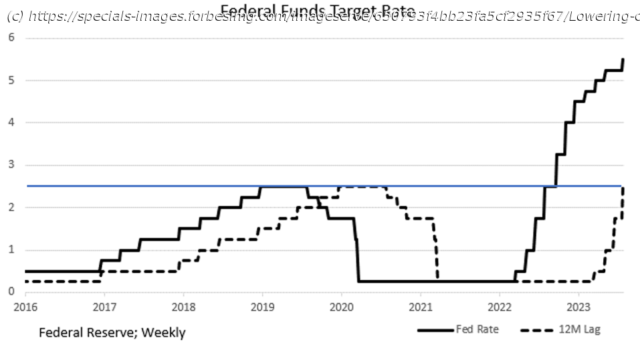

Several weeks ago, we described the effectiveness of monetary policy on the economy if it acted with a 12-month lag. The San Francisco Regional Federal Reserve Bank recently published research showing the lag to be 11 months. The Fed has also indicated that the “neutral” Fed Funds rate is 2.5%, so effective rates below 2.5% are accommodative and those above 2.5% are restrictive. In July, 2022, the Fed Funds rate was 2.5%. So, according to the SF Fed, up until June, 2023, Fed policy actually remained “accommodative.” Of course, the Fed has continued to rapidly raise rates. The economy has shown signs of weakening as the rate rises have moved toward restriction. As seen from the chart, given the lags, “restrictive” policy is about to bite, and bite hard!From Growth to Recession

A Recession just doesn’t appear one day. It is a gradual process that takes the economy from positive to negative growth. Economist David Rosenberg, in his recent daily missives, has pointed out that in going from positive to negative growth, the economy must transition through zero growth. His conclusion is that we are close to that today, and, perhaps, that is what the “soft-landing” proponents are looking at. For us, the important question to ask, and one that is answered by our chart, is: If we have miniscule growth today, when the effective rate has just reached “neutral,” what is the likely growth path for the economy as the effective rate more than doubles over the next year? The logical conclusion: negative growth, i.e., Recession.Incoming Data

It is widely held by economists that the trillions of dollars of giveaways by the federal government have run their course, i.e., have been spent and are no longer available to support consumption. Consumer savings have fallen significantly below their pre-pandemic levels, so consumers would now have to borrow to keep consumption at current levels. And borrow, they have, as credit card balances have now reached a $trillion.

And, just as borrowing has soared, so have delinquencies. And don’t you just know it, those terrible banks have all tightened their lending standards. We see this from the Fed’s SLOOS (Senior Loan Officer Opinion Survey) and from other business surveys including the Fed’s own Beige Book which noted slowing demand and easing inflation concerns.

Jobs aren’t as easy to get as they were a year or so ago. The chart shows hires (green line) have fallen dramatically from their peak in November 2021 and quits (red line) are off significantly from their peak in April 2022. The latter are also showing quite dramatic recent deceleration. The unemployment rate ticked +0.3 pct. points higher in August.

We don’t think it is just coincidence that all the above occurred just as the “effective” Fed Funds rate (i.

Home

United States

USA — Financial The Inflation War Has Been Won; Time To Start Fighting The Recession