The Mexican peso briefly spiked more than 1 percent against the U. S. dollar on Thursday after Mexico’s central bank took steps to buttress its slumping currency.

The Mexican peso briefly spiked more than 1 percent against the U. S. dollar on Thursday after Mexico’s central bank took steps to buttress its slumping currency.

Juan Garcia, director of national operations for the bank, told Reuters it began selling dollars, but did not specify how many dollars the bank was selling. The peso hit an all-time low versus the dollar on Wednesday, amid uncertainty over President-elect Donald Trump’s trade policies.

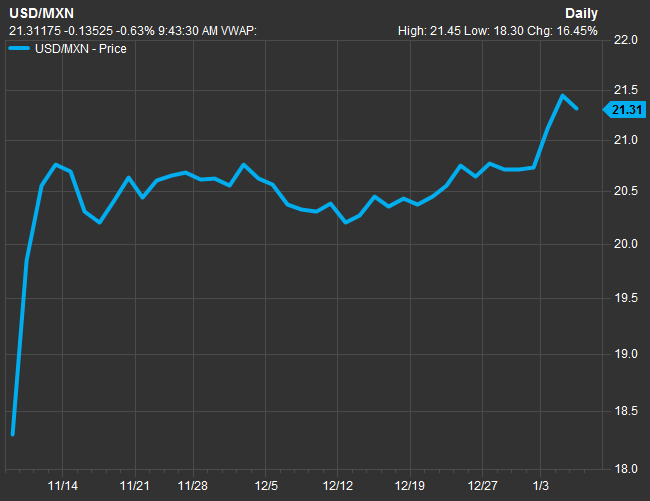

Mexico’s currency has taken a beating since Trump shocked the world by winning the U. S. presidential election. Trump called for an overhaul of the North American Free Trade Agreement and has repeatedly said he will construct a wall along the U. S.-Mexico border. Since Nov. 8, the peso has shed more than 16 percent against the dollar.

Marc Chandler, global head of currency strategy at Brown Brothers Harriman, said he expects the peso’s weakness against the dollar to persist, but added that Wednesday’s sell-off was « a bit exaggerated. »

« If the intervention can push the peso below 21 (to the dollar), we could see some consolidation, » Chandler said. « If the peso can break below 20.70, it would be even more convincing. »

The peso traded around 21.30 to the dollar, up 0.8 percent, as of 9:54 a.m. ET.