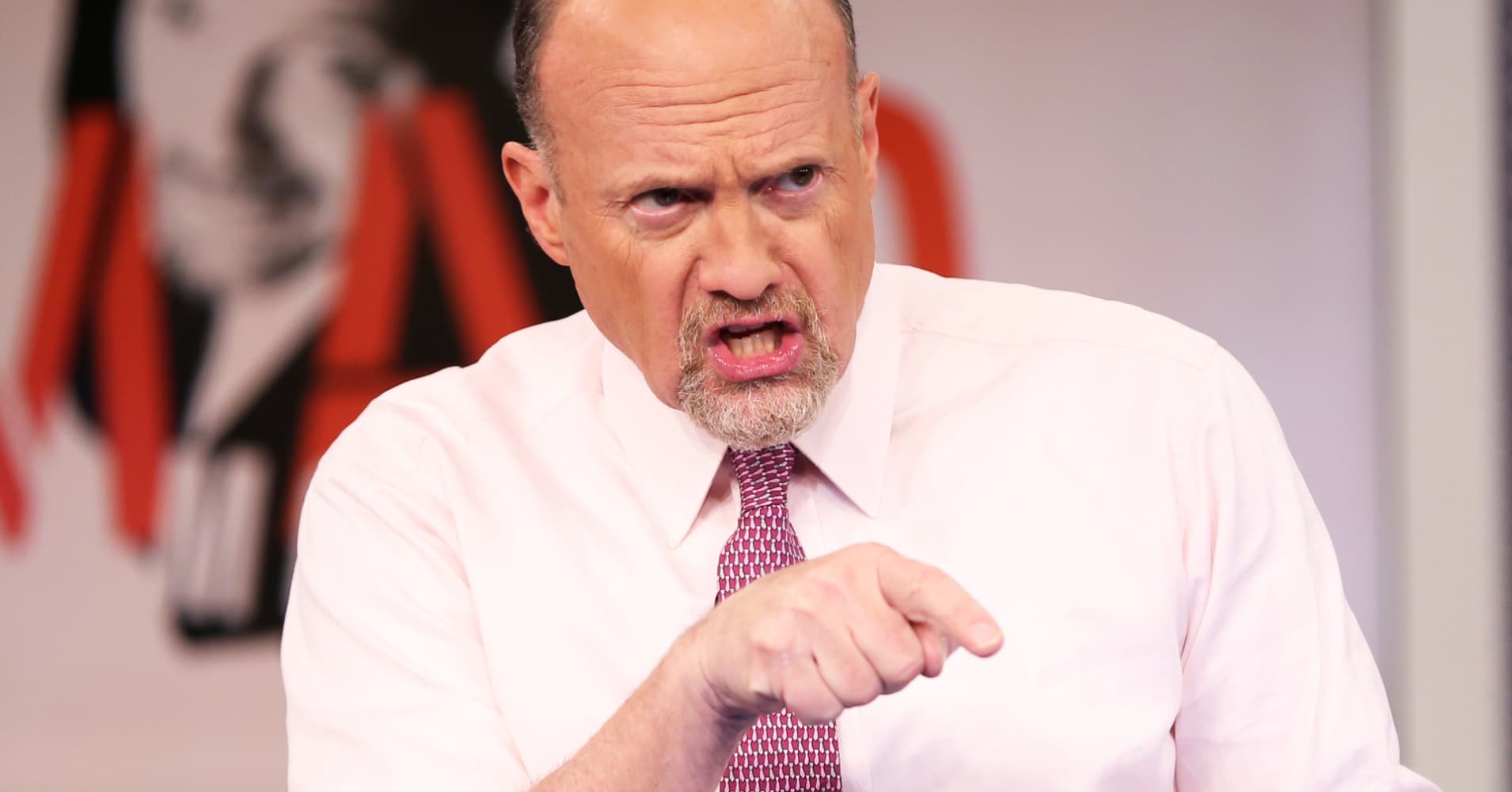

Jim Cramer learned a lesson from the market’s reaction to President Donald Trump ‘s action on immigration.

Jim Cramer learned a lesson from the market’s reaction to President Donald Trump ‘s action on immigration.

Usually when a president has a pro-business agenda, the market will gobble it up and buy stocks. But when things are happening too fast with issues that have nothing to do with business, investors get nervous and the stock market begins to sell off.

« Politics and money do mix, they just don’t mix all that easily when it comes to the stock market, » the » Mad Money » host said.

Wall Street loves Trump’s economic agenda of deregulation, repatriation of overseas assets and lower corporate taxes. But when Trump introduces political risk into the market, Cramer advised to ring the register.

« With business improving across the board, it is political risk that can hurt this market now more than anything else that I see, » Cramer said.

When Trump speaks, he moves the market. Cramer says the key is to understand that he does it in strange ways that can sometimes impact the market severely, and sometimes just be a glancing blow.

« As long as we are ready for his comments, we can profit from them, » Cramer said.

More importantly, Cramer said to get used to them occurring. They can be jarring, but it shouldn’t freak the market out every time it happens.

Cramer spoke with Ethan Allen CEO Farooq Kathwari, who commented on the scene at the airports in protest to Trump’s travel ban over the weekend.

Ethan Allen Interiors has approximately 300 design centers that oversee the home decor, design and furniture needs of a home.

Kathwari said he came to the U. S. as a student and worked during the day, and went to NYU to get his degree at night. Just seven years later he became the CEO of a financial company on Wall Street, and has led Ethan Allen for 30 years.

« Where else in the world would somebody with a name like Farooq, born in a war-torn country like Kashmir, than America? I mean I love America. America is great and you must give opportunity to others as well, » Kathwari said.

Shares of equipment rental company United Rentals surged last week after delivering a blowout quarter, sending the stock up 11 percent on Thursday.

United Rentals rents machinery to construction firms, utilities, industrials, oil and gas companies, homebuilders and government entities. Since the election, many investors have flocked to United Rentals in anticipation of Trump’s spending on infrastructure.

Cramer spoke with United Rentals CEO Michael Kneeland, who attributed the increased demand at the end of the year to better unemployment data.

« What we noticed as we went through the fourth quarter, we really saw a pick-up of demand in December, which was a little unusual off season, » Kneeland said.

Specialty vehicle maker Rev Group went public on Friday, and Cramer feared it could have been lost in the shuffle of worries about Washington .

Rev Group makes vehicles such as school buses, ambulances, fire trucks, street sweepers, mobility vans and RVs. What really caught Cramer’s attention was that it is run by Tim Sullivan, former CEO of Bucyrus who made the brilliant move to sell the company to Caterpillar in 2010, close to the top of the commodity cycle.

« For now, I say it is too soon to get involved, although with a guy like Tim Sullivan at the helm, I may end up eating my words, » Cramer said.

In the Lightning Round , Cramer gave his take on a few caller favorite stocks:

Cisco Systems : « My charitable trust has a big position … Cisco’s business is good. I like that acquisition that Chuck Robbins [CEO] did last week that he came on Squawk about. That stock is a buy. »

United States Steel Corporation : « In the end I’ve got to default to best-of-breed. The best-of-breed is Nucor, even though it doesn’t necessarily have those business lines. If you want a steel stock, I have never gone wrong recommending Nucor since 1985. You think I’m going to change my stripes now? No. «