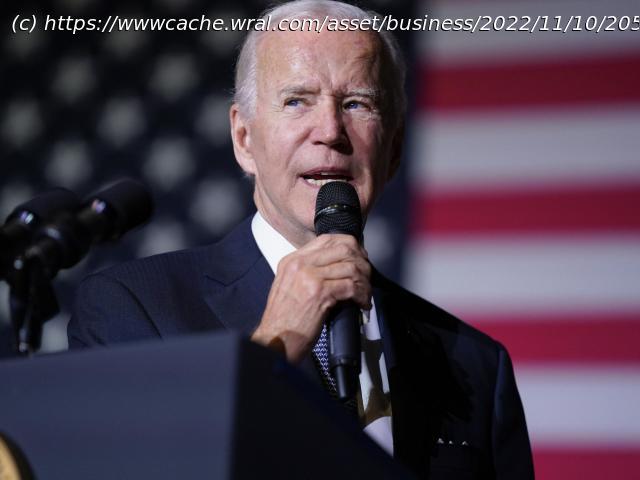

A federal appeals court in St. Louis has created another roadblock for President Joe Biden’s plan to provide millions of borrowers with up to $20,000 apiece in federal student-loan forgiveness.

A federal appeals court in St. Louis has created another roadblock for President Joe Biden’s plan to provide millions of borrowers with up to $20,000 apiece in federal student-loan forgiveness.

A federal appeals court in St. Louis has created another roadblock for President Joe Biden’s plan to provide millions of borrowers with up to $20,000 apiece in federal student-loan forgiveness.

The court on Monday agreed to a preliminary injunction halting the program in one of several cases challenging the debt relief plan.

With the forgiveness program on hold, millions of borrowers have begun to wonder if they’ll get debt relief at all. The fate of the plan will likely eventually end up in the Supreme Court.

Here’s where things stand:

HOW THE FORGIVENESS PLAN WORKS

The debt forgiveness plan announced in August would cancel $10,000 in student loan debt for those making less than $125,000 or households with less than $250,000 in income. Pell Grant recipients, who typically demonstrate more financial need, would get an additional $10,000 in debt forgiven.

College students qualify if their loans were disbursed before July 1. The plan makes 43 million borrowers eligible for some debt forgiveness, with 20 million who could get their debt erased entirely, according to the administration.

The Congressional Budget Office has said the program will cost about $400 billion over the next three decades.

The White House said 26 million people have applied for debt relief, and 16 million people had already had their relief approved.

A HOLD ON THE PLAN GETS EXTENDED

The ruling Monday was made by a three-judge panel from the 8th U.S. Circuit Court of Appeals in St. Louis, which has been considering an effort by the Republican-led states of Nebraska, Iowa, Kansas, Missouri, Arkansas and South Carolina to block the loan forgiveness program.