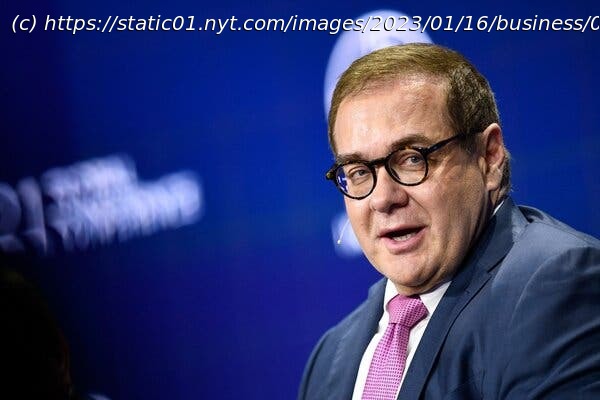

He helped turn Guggenheim Partners into a global investing giant. He was also a CNBC and Bloomberg commentator and a philanthropist for human rights.

Scott Minerd, who helped transform a small investment firm of the Guggenheim family into a global financial behemoth, becoming one of Wall Street’s leading voices in the process, died on Dec. 21 in Vista, Calif. He was 63.

In a statement, Guggenheim Partners said the cause was a heart attack he suffered during a workout.

As the global chief investment officer of Guggenheim Partners, Mr. Minerd was a regular commentator on Bloomberg Television and CNBC and a fixture at the World Economic Forum in Davos, Switzerland. His financial prognostications were closely followed by investors. He was also a key adviser to the Federal Reserve Bank of New York on financial markets.

Mr. Minerd joined Wall Street in his 20s, just as the industry was experiencing a boom. Between 1983 and 1996, he rose rapidly through the ranks at Merrill Lynch and Morgan Stanley and ran the bond trading desk at Credit Suisse First Boston. But at 37 he retired from banking and moved to Venice Beach, Calif., to pursue a passion for bodybuilding.

Although he remained a dedicated weight lifter for the rest of his life, his retirement didn’t last long, however. In 1998, Mark Walter, a Chicago-based financier, sought out Mr. Minerd to join a new firm he was building that would become Guggenheim Partners.

Mr. Minerd proceeded to help turn Guggenheim into a global powerhouse. It recently managed $285 billion on behalf of insurance firms, pension funds, sovereign wealth funds and other clients and has 900 employees in the United States, Europe, Asia and the Middle East.

Mr. Minerd built a reputation for foreseeing the impact of events early on. In 2007, he was among the first financiers to spot the impending global financial crisis and promptly moved Guggenheim’s assets into safer investments, avoiding the worst of the fallout.