The program would cancel up to $10,000 in federal student debt for Americans earning less than $125,000 annually, and an additional $10,000 for recipients of Pell Grants.

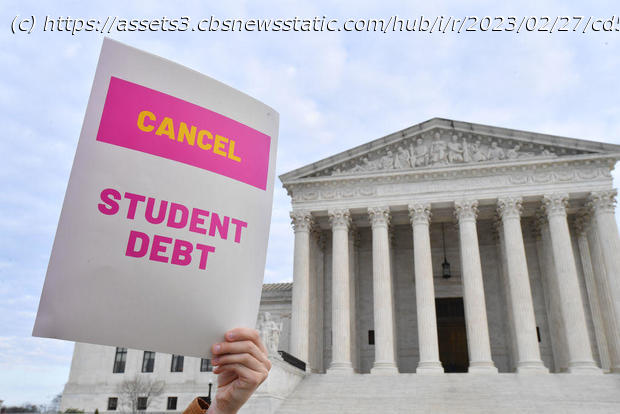

The Biden administration’s plan to cancel up to $20,000 in federal student loan debt for millions of Americans will come under scrutiny by the Supreme Court on Tuesday, facing a crucial test from a conservative court that has been wary of broad claims of executive power.

The program, unveiled in August, satisfies a campaign promise from President Biden and would provide relief to more than 40 million borrowers, 20 million of whom would have their loan balances wiped out altogether, the White House estimates.

But with a cost of roughly $400 billion, a group of six states and two borrowers from Texas are pushing the Supreme Court to invalidate the program and argue the Biden administration unlawfully invoked the COVID-19 pandemic to claim «breathtaking and transformative power,» according to a court filing from the states.

Arguments in the pair of cases to be heard by the justices Tuesday are the culmination of a political and constitutional clash that has left millions of borrowers in limbo. The Department of Education in November stopped accepting applications for the program and loan service providers are prevented from discharging any debt as a result of the legal challenges.

The court is set to consider two questions when it convenes for arguments: first, whether the states and borrowers have the legal right to challenge the program, a concept known as standing, and then whether the Biden administration exceeded its authority with its plan to eliminate $430 billion of federal student loan debt.

Key to whether the justices even weigh the lawfulness of the program is whether the Biden administration can persuade a majority of the court that neither the GOP-led states nor the two borrowers, Myra Brown and Alexander Taylor, have the legal standing to sue.

«Going back decades, the Supreme Court has been pretty clear on its rules for what a plaintiff needs to be able to bring a case in court,» David Nahmias, a staff attorney with the Berkeley Center for Consumer Law and Economic Justice, told CBS News. The center filed a brief on behalf of Missouri consumer advocates in support of the Biden administration, arguing the states’ threatened harms are «speculative.»

«The court has made it very clear that you need a concrete harm, a concrete injury that is not abstract or hypothetical. It’s an actual harm or imminent harm, and they’ve made that very clear, time and again, in their decisions,» he said.

In the case brought by the six states — Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina — a federal district court in St. Louis dismissed the case for lack of standing. But a federal appeals court , finding that «Missouri is harmed from the financial losses that the cancellation inflicts.»

The appeals court focused its decision on the Higher Education Loan Authority of the State of Missouri, or MOHELA, a state-created entity that services federal student loans, finding that the financial impact on the loan servicer due to the debt discharge threatened financial harm to Missouri.

Домой

United States

USA — Financial Biden's student loan forgiveness plan to face crucial test at Supreme Court