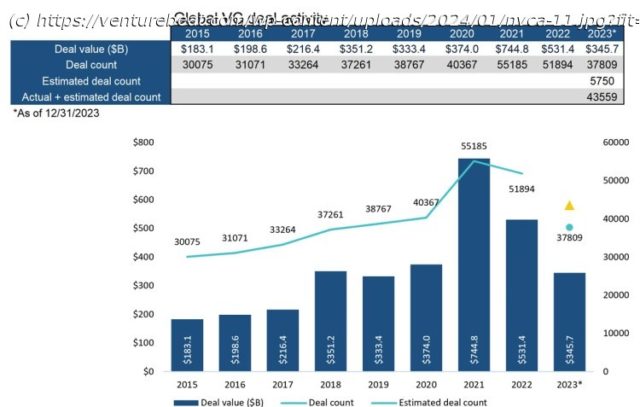

In 2023, U.S. venture capital deal activity continued its slump from the highs two years ago, and global VC investments fell to the lowest levels since 2019.

In 2023, U.S. venture capital deal activity continued its slump from the highs two years ago, and global VC investments fell to the lowest levels since 2019.

In 2023, 15,766 deals were completed in the U.S., but, more importantly for the industry, just $170.6 billion was invested into companies, which is roughly half of the amount invested in 2021 and highlights the shortage of capital availability private companies are facing, according to a report by Pitchbook and National Venture Capital Association.

U.S. exits returned just $61.5 billion to investors during the year. Large tech initial public offerings (IPOs) were especially sparse considering the high number of unicorns that remain private. The inability to return money to investors has challenged the free-flowing capital into VC, based on the first look details of the report.

After a record year for closed funds in 2022, just $66.9 billion was committed to VC funds during the 2023 in the U.