As climate change intensifies the violence of storms like Hurricane Helene, the industry is in a self-induced crisis.

As climate change intensifies the violence of storms like Hurricane Helene, the industry is in a self-induced crisis.

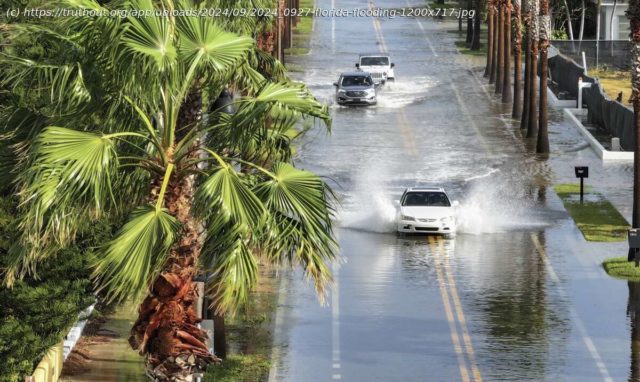

Hurricane Helene slammed into the Florida coast on Thursday night, bringing pounding rains and “fierce, whipping winds that sounded like jet engines revving,” according to the New York Times. As it ripped through Florida and moved into Georgia, more than 2 million people lost power. While hurricanes are no stranger to the Gulf Coast, climate change has intensified their destructive impacts, and Hurricane Helene is the just the latest case of the extreme weather events that are rising in their frequency and ferocity.

Over the past year, the corporate media, from The to the Financial Times, have covered a rising crisis for the insurance industry that’s being caused by extreme weather events like Hurricane Helene: the growing risks and skyrocketing costs of insuring homes and other properties across wide swaths of the U.S. The popular New York Times podcast “The Daily” went so far as to run an episode titled “The Possible Collapse of the U.S. Home Insurance System.”

Across virtually all of this coverage, the “insurance industry” and “extreme weather” are posed as entirely separate phenomena that now happen to be clashing to create a “crisis.” But a critical fact is omitted from this narrative: For the insurance industry, this is largely a self-induced crisis because of its massive, decadeslong underwriting of — and investment in — the very fossil fuel operations that are driving climate change-induced extreme weather events.

Top insurers, from AIG to Liberty Mutual to Chubb, together rake in billions of dollars annually by underwriting the global buildout of oil and gas pipelines, offshore drilling, Liquefied Natural Gas (LNG) export terminals and other fossil fuel operations. These insurers also have tens of billions of dollars invested in fossil fuels. The insurance industry is a major culprit — not a hapless victim — of the extreme weather that is now endangering its own business model and creating personal catastrophes for ordinary homeowners.

“It’s really this vicious hypocritical cycle of insurers propping up climate change and then taking away home insurance or hiking up the prices,” Helen Humphreys, communications coordinator for Connecticut Citizen Action Group, which is campaigning around fossil fuel insurers, told Truthout.

Organizers from New England to the Gulf Coast are working tirelessly to hold insurers to account, demanding they stop underwriting new fossil fuel projects and phase out insurance for current ones, and supporting legislation, especially at the state level, to drive a wedge between dirty energy companies and the insurers that prop up their oil, gas and coal operations.“An Important Cog in the Fossil Fuel Industry Machine”

Extreme weather events like hurricanes, flooding and wildfires, intensified by climate change, are creating a major problem for insurance companies, which are increasingly paying out more in damage payments than they are receiving in premium payments. In 2023, for example, insurers lost money on homeowner coverage in 18 states, as compared to eight states in 2013; some insurance companies are abandoning entire regions, drastically reducing their coverage in risky states like Florida and California.

Insurers raised their rates for homeowners’ coverage by double digits in 2023, and some states have seen astronomical rises in premiums. Between 2018 and 2023, homeowners’ insurance costs skyrocketed by 42.2 percent in Oklahoma, 43.2 percent in Florida and 48.6 percent in Nebraska, just to name a few.

“When you think about climate change, insurance isn’t always the first thing that comes to mind,” said Humphreys. “Insurance companies are an incredibly important cog in the fossil fuel industry machine. Without insurance, fossil fuel projects cannot move forward.”

Insurance companies provide coverage for fossil fuel infrastructure that could otherwise not receive permits to be built or operate or attract investors. Insure Our Future, a campaign made up of environmental, consumer protection and grassroots groups, recently estimated that Liberty Mutual takes in $500 million in annual premium payments from insuring fossil fuels, while AIG took in $550 million, Farmers took in $600 million and Chubb took in $700 million.

The insurance industry is a major culprit — not a hapless victim — of the extreme weather that is now endangering its own business model and creating personal catastrophes for ordinary homeowners.

The Gulf Coast is a major hub for LNG export terminals, all of which are enabled by nearly three dozen insurance companies like AIG, Chubb, Liberty Mutual and Lloyd’s of London.

Домой

United States

USA — Science As Florida Floods, Insurance Industry Reaps What It Sowed Backing Fossil Fuels