GamesBeat Next is almost here! GB Next is the premier event for product leaders and leadership in the gaming industry. Coming up October 28th and 29th, join fellow leaders and amazing speakers like Matthew Bromberg (CEO Unity), Amy Hennig (Co-President of New Media Skydance Games), Laura Naviaux Sturr (GM Operations Amazon Games), Amir Satvat (Business […]

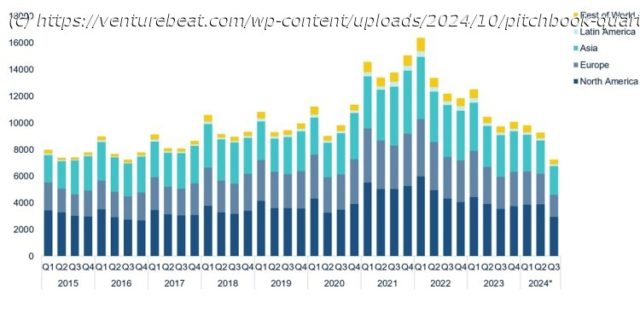

Global venture capital activity declined in Q3, confirming that 2024 will be another weak year for venture investments and exits, according to the Q3 2024 Pitchbook/NVCA Venture Monitor First Look.

By just about every number, Q3 was weak and 2024 overall doesn’t compare well in terms of numbers of deals, average deal size, VC fundraising, exits and dollar amounts raised. No particular region stood out in terms of great performance, based on the report from Pitchbook and the National Venture Capital Association.

PitchBook’s lead VC analyst Kyle Stanford said in a statement that dealmaking in the U.S. showed its first quarter-over-quarter decline in a year. Just an estimated 3,777 VC investment deals were completed during the quarter, falling back to pre-2021 levels.

The median valuations for these stages is high, but there has been upward pressure on the figure due to previous high multiple valuations for companies now finally coming back to raise again. Deal value during Q3 was lowest of the year due to few outsized rounds being raised. Median deal sizes have also seen an

uptick from 2023, but they remain well below the median from 2021. Stronger companies raising capital are receiving larger deals to help weather the market slowdown.

Exits continued to find little in terms of success in the market. Just 10 companies went through a public listing in the U.S., and $11.2 billion in total exit value was created during the quarter. The large number of companies that remain stuck in the private market are weighing on distributions back to limited partners, which causes further challenges within VC.

Stanford said, in perhaps the only bright spot, was that the rate cut from the Federal Reserve in September is a good step to balancing costs of borrowing and relieving pressure on public markets that

could help begin the registration process for companies moving forward.