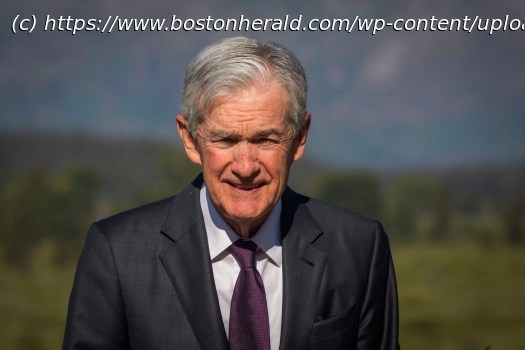

Now that Federal Reserve Chair Jerome Powell has signaled that the central bank could soon cut its key interest rate, he faces a new challenge: how to do it without seeming to cave to the White House’s demands.

Now that Federal Reserve Chair Jerome Powell has signaled that the central bank could soon cut its key interest rate, he faces a new challenge: how to do it without seeming to cave to the White House’s demands.

For months, Powell has largely ignored President Donald Trump’s constant hectoring that he reduce borrowing costs. Yet on Friday, in a highly-anticipated speech, Powell suggested that the Fed could take such a step as soon as its next meeting in September.

It will be a fraught decision for the Fed, which must weigh it against persistent inflation and an economy that could also improve in the second half of this year. Both trends, if they occur, could make a cut look premature.

Trump has urged Powell to slash rates, arguing there is “no inflation” and saying that a cut would lower the government’s interest payments on its $37 trillion in debt.

Powell, on the other hand, has suggested that a rate cut is likely for reasons quite different than Trump’s: He is worried that the economy is weakening. His remarks on Friday at an economic symposium in Grand Teton National Park in Wyoming also indicated that the Fed will move carefully and cut rates at a much slower pace than Trump wants.