The billionaire investor reflected on his best purchases, and defended Berkshire Hathaway’s stock buybacks and tax contributions.

Warren Buffett struck a proud, reflective tone in his annual letter to Berkshire Hathaway shareholders, published on Saturday.

The famed investor and Berkshire CEO highlighted the best bets of his career, defended his conglomerate’s stock buybacks and tax contributions, and slammed managers who manipulate their companies’ earnings to meet Wall Street’s expectations.

«Our satisfactory results have been the product of about a dozen truly good decisions — that would be about one every five years,» Buffett said.

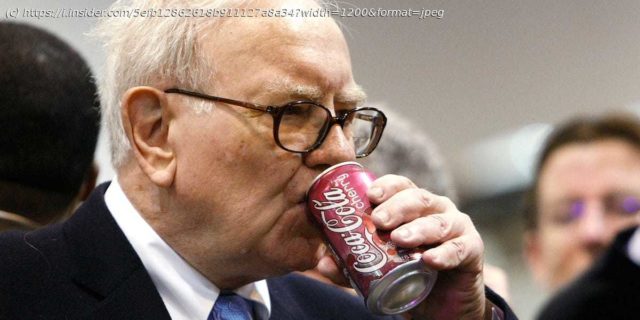

The billionaire executive pointed to Berkshire’s stakes in Coca-Cola and American Express, two cornerstones of his roughly $300 billion stock portfolio. Buffett’s company originally invested $1.3 billion in the soda giant for a position worth $25 billion at the end of last year. It piled another $1.3 billion into the credit-card titan for a stake worth $22 billion on December 31.

Moreover, Berkshire received $704 million in yearly dividends from Coca-Cola last year, and $302 million from American Express, Buffett noted. When it first completed building both positions in 1994 and 1995 respectively, they paid only $75 million and $41 million in annual dividends.

Домой

United States

USA — Financial Warren Buffett touts his iconic Coca-Cola and American Express bets in his...